Automatic Take Profit Stop Loss Order on Tastyworks Mobile A...

38 views · Dec 19, 2022 shortthestrike.com

Today we’ll be diving into the tastyworks mobile app to learn all about how to automate a bit of our trading. This is through the use of One-Cancels-Other, or OCO Bracket orders. We’ll quickly learn how to place this on one of our current positions, then as part of a brand new trade, and even how to do it on an option contract as well.

How to Short Stock on Tastyworks Mobile App

63 views · Dec 19, 2022 shortthestrike.com

Today we'll learn how to short stock on the Tastyworks Mobile App. We'll go through the entire process of opening and closing a short position every step of the way. Shorting stock is a risky, but potentially profitable way to make money from a stock going down in value. It is essentially borrowing stock from your broker, then selling those shares in the market. At a later date, you’re then hoping to buy those shares back at a lower price and profit the difference. Just be careful if you’re just getting started and stay small so you don’t get yourself in too much trouble. There is literally unlimited risk potential to the upside, so be sure learn everything possible before incorporating this in your own trading.

How to Set OCO Bracket Order on Tastyworks Desktop Platform

1K views · Dec 17, 2022 shortthestrike.com

Open a Tastyworks Account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J In today’s video we’ll learn how to create a bracket order on the tastyworks platform. You may also know this as a take profit and stop loss order or a one cancels the other order (OCO). You’ll use this as a simple way to automate some of your trading. Creating an order ticket to close your position if the stock goes against you while simultaneously having another order out to close the position if it ever hits your profit target. Whichever order fills first, the other order is automatically cancelled. ➤Open a Tastyworks Account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Create and Customize a Watchlist on Tastyworks

3K views · Dec 17, 2022 shortthestrike.com

Open a Tastyworks Account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J In today’s video we’ll learn to create and customize a watchlist on the tastyworks desktop platform. We’ll go through the process of creating a watchlist from scratch, pulling up past watchlists and customizing the columns to display the information we find most valuable. Creating a watchlist on tastyworks is an incredibly easy process. I personally have several watchlists that are each focused on their own respective area. One watchlist is made to keep track of the index so I always know what’s happening with the overall market. Another is for stocks that I often sell options against. Finally, sector watchlists that only show companies in a specific industry. Once you’ve created a watchlist you can also edit the column headers to only display the information you find most valuable. This could things as simple as the last traded price, bid/ask, or volume. You could also include liquidity ratings, IV Rank, IV Percentile, or various other information. ➤ Open a Tastyworks Account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Place Stop Loss Order on Tastyworks

465 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to place stop loss orders on the tastyworks desktop platform. A stop loss is designed to limit an investor's loss on a security position. For example, setting a stop-loss order for 10% below the price at which you bought the stock will limit your loss to 10%. Within tastyworks, you can use either stop market orders or stop limit orders.

How to Buy and Sell Options on Tastyworks

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to buy and sell options on the tastyworks desktop platform. Tastyworks was built specifically for options traders and is one of the best platform available to retail traders. To make sure you get the hang of it, we'll go through the entire process of buying and selling options every step of the way.

How to Buy and Sell Stock on Tastyworks

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to buy and sell stock on the tastyworks desktop platform. There are several different ways to buy and sell stock on the tastyworks platform. The simplest way is to click on either the bid/ask price when you want to generate an order ticket. Once the order ticket pops up you can input the quantity, price, order type, and time in force you intend to use for the order. You can also place orders using the grid page and the active tab. The grid will allow you to view a chart while simultaneously placing trades. Whereas the active tab will allow you place trades on a number of stock very quickly. It is the fastest way to place trades on the platform, but it is a bit more advanced and will be explained in a separate video.

How to Create OCO Bracket Order on Tastyworks Mobile App

5 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to place OCO bracket orders on the tastyworks mobile app. You may also know it as a take profit / stop loss order, but its all the same thing. Its simply an advanced order that allows you to close your position at a profit while simultaneously working to close your position if it goes against you to hopefully stop you from losing too much money. Now these are two separate orders both trying to fill, whichever one fills first, the other is automatically cancelled. Throughout this video we'll go through several different examples. Placing OCO brackets on both long calls and long puts. As well as short calls and short puts.

How to Place a Stop Loss on Tastyworks Mobile App

31 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to place stop loss orders on the tastyworks mobile app. We’ll go through a few examples both with stock and options. A stop loss order can be used to manage positions that go against you. Closing a position automatically if hits a certain price. Within tastyworks you can use either stop market orders or stop limit orders. We’ll go through several different examples of certain situation where one would make more sense than the other.

How to Trade Options on the Tastyworks Mobile App

10 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to buy and sell options on the tastyworks mobile app. We’ll use many different examples, both on long and short calls and puts. Options are an amazing tool in can be used in a variety of different ways. Whether that be speculating on direction, hedging risk, or as a way to generate income. All of these different options strategies can be done within the Tastyworks mobile app.

How to Trade Stock on Tastyworks Mobile App

13 views · Dec 17, 2022 shortthestrike.com

In today's video we'll learn how to buy and sell stock on the tastyworks mobile app. Timestamps 0:00 Intro 0:41 How to Buy Stock 6:28 How to Short Stock 7:45 How to Close Open Position ➤ Open a Tastyworks Account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Trade Spreads on Tastyworks Mobile App (Vertical Spre...

26 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to trade options spreads on the tastyworks mobile app. We’ll specifically cover both short and long vertical spreads, iron condors, and butterfly spreads. Vertical spreads: A vertical spread involves the simultaneous buying and selling of options of the same type (i.e., either puts or calls) and expiry, but at different strike prices. This can be done as either a long vertical or as a short vertical. Iron Condors: An iron condor is an options strategy consisting of two puts (one long and one short) and two calls (one long and one short), and four strike prices, all with the same expiration date. The iron condor earns the maximum profit when the underlying asset closes between the middle strike prices at expiration. Butterfly spreads: A butterfly is an options strategy that combines bull and bear spreads with a fixed risk and capped profit. These spreads are intended as a market-neutral strategy and pay off the most if the underlying asset does not move prior to option expiration.

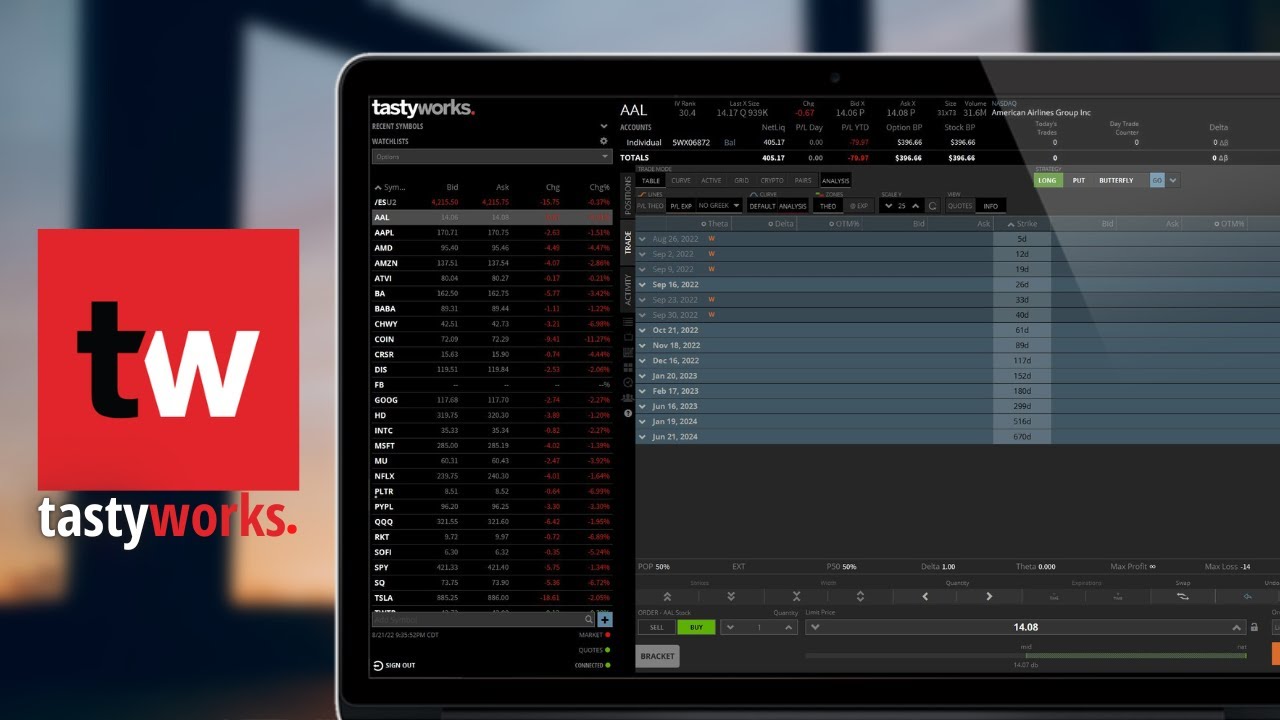

Tastyworks Desktop Tutorial for Beginners 2022 | Step-by-Ste...

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll be doing a step-by-step tutorial of the Tastyworks desktop platform. There is a lot to cover and many different features to go over. But in today’s video I’m going to focus on things I think you’ll be using on a daily basis. That’s going to include the overall navigation of the platform, how to create and customize watchlists, how to place trades on both stock and options, utilizing and customizing the charts, and various other tools I think you’ll find useful.

Tastyworks Mobile App Tutorial for Beginners 2022 | Step-by-...

64 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll do a full demo of the tastyworks mobile app. We’ll cover everything you’ll need to know to get started trading on the app. Everything from how to buy and sell stock, options, and managing open positions. Timestamps 0:00 Intro 0:40 General Navigation 2:31 Create & Customize a Watchlist 7:50 View Charts & Stock Info 9:28How to Buy & Sell Stock 13:49 Option Chain Explained 16:34 How to Buy & Sell Options 23:09 Closing an Open Position ➤ Open a Tastyworks Account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Trade Spreads on Tastyworks (Verticals, Iron Condors,...

549 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to create various different spreads on the tastyworks platform. Timestamps 0:00 Intro 1:04 Option Chain Explained 4:45 Long Call Spread 11:47 Short Put Spread 15:45 How to Place an Iron Condor 21:12 Butterfly Spread Vertical Spreads A vertical spread is an options strategy that involves buying (selling) a call (put) and simultaneously selling (buying) another call (put) at a different strike price, but with the same expiration. Vertical spreads limit both risk and the potential for return. Iron Condor An iron condor is an options strategy consisting of two puts (one long and one short) and two calls (one long and one short), and four strike prices, all with the same expiration date. The iron condor earns the maximum profit when the underlying asset closes between the middle strike prices at expiration. Butterfly Spread A butterfly spread is an options strategy that combines both bull and bear spreads. These are neutral strategies that come with a fixed risk and capped profits and losses. Butterfly spreads pay off the most if the underlying asset doesn't move before the option expires. ➤ Open a Tastyworks Account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Fastest Way to Trade Stock on Tastyworks | Active Trader Tut...

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’re going to learn how to use the active trader on the tastyworks platform. This tool is probably the fastest way to trade stock and futures, so for those of you day traders out there, you may find this useful. ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

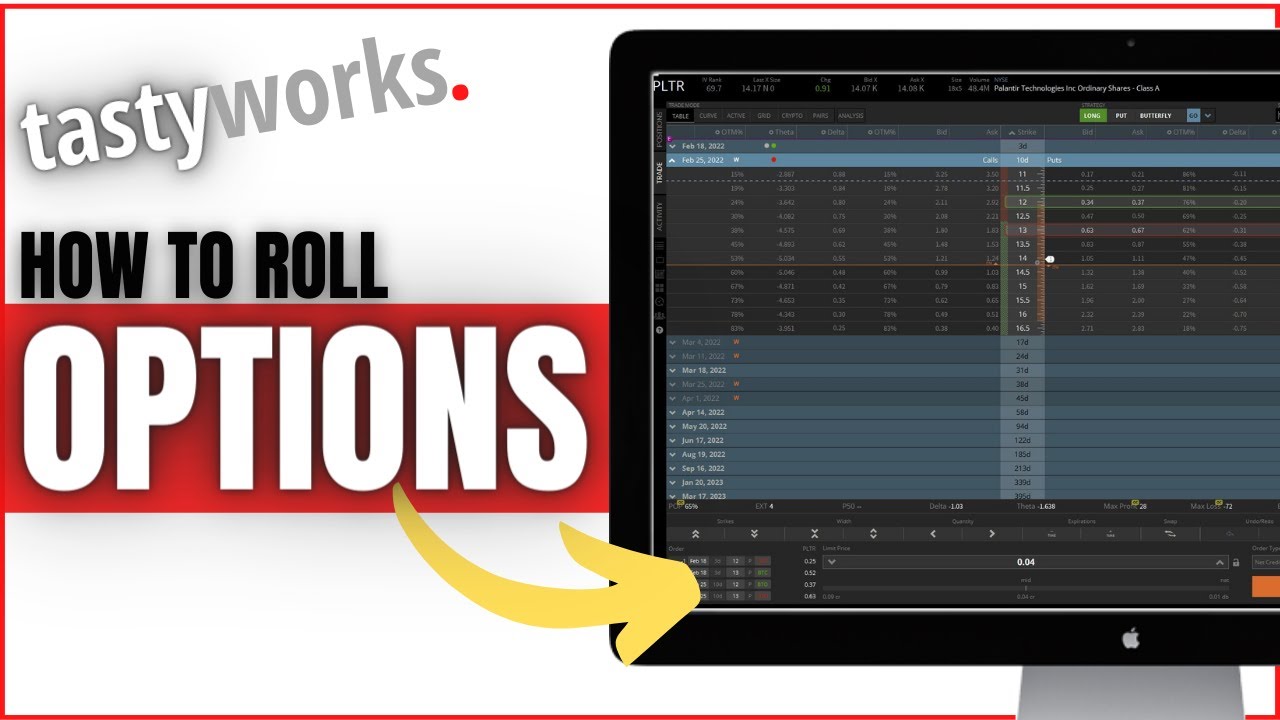

How to Roll an Option on Tastyworks Desktop Platform

1K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to roll options on the tastyworks platform. We'll be going through several examples for both single leg options as well as spreads. This should give you enough practice with rolling options so you feel comfortable doing it yourself. However, the rolling process is pretty much the same for both single leg options and spreads.

Tastyworks Tutorial for Absolute Beginners 2022 | Step-by-St...

5K views · Dec 16, 2022 shortthestrike.com

Today we'll be doing a full step-by-step tutorial of the Tastyworks Desktop Platform. Learning all the important tools and features you'll need when first getting started. Tastyworks is one the best trading platforms out there for options traders and one of my personal favorites even after using nearly every trading platform out there. It offers of bunch of great features, tools, and customizations that are tailored made for options.

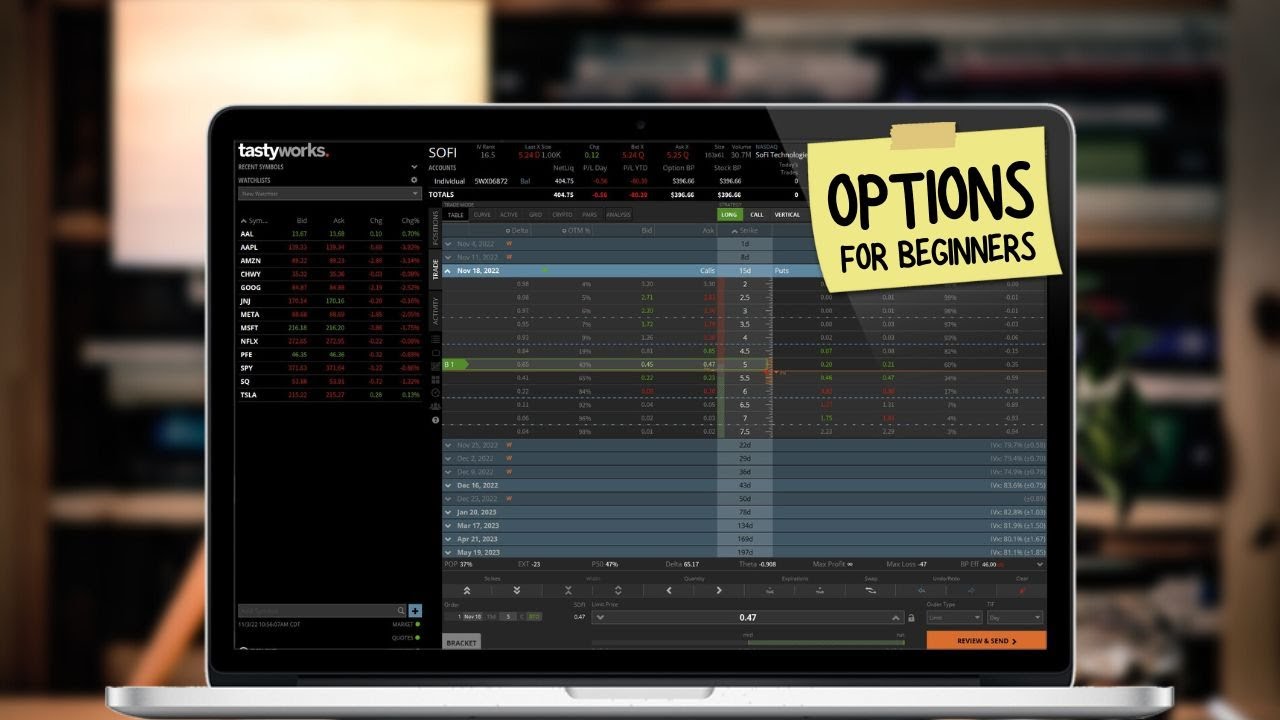

Trading Options on Tastyworks for Beginners (Step-by-Step Tu...

2K views · Dec 16, 2022 shortthestrike.com

Today we'll cover the basics on how to buy and sell options in the Tastyworks desktop platform. Options are an amazing tool and can be used in so many different ways. Whether it be generate income, hedge risk, or bet on direction. You can be as conservative or as insanely risky as you want, and everything in between. We’ll go over a quick introduction to what options are, a few of the most popular strategies out there, and how to actually trade them within Tastyworks. We'll specifically cover how to buy calls and puts, close open options trades, and how to customize the option chain.

How to Short Stock on Tastyworks

2K views · Dec 16, 2022 shortthestrike.com

Today we'll learn how to short stock on the Tastyworks Desktop platform. Shorting stock is a risky, but potentially profitable way to make money from a stock going down in value. It's essentially borrowing stock from your broker, then selling those shares in the market. At a later date, you’re then hoping to buy those shares back at a lower price and profit the difference. Today we'll learn how to short stock within Tastyworks and how to close the position at a later date. We'll also learn how to short using the active trade tool as well.

Automatic Take Profit & Stop Loss on Tastyworks

2K views · Dec 16, 2022 shortthestrike.com

Today we’ll learn how to place OCO bracket orders, or take profit/stop loss orders on the Tastyworks Desktop Platform. OCO bracket orders, also known as take profit stop loss orders allow us to automate our trading. We’ll quickly learn how to place this on one of our current positions, then as part of a brand new trade, and even how to do it on an option contract as well. These allow us to set orders in advance and have both the profit taking and stop loss orders work for us automatically.

Automatic Take Profit Stop Loss Order on Tastyworks Mobile A...

38 views · Dec 16, 2022 shortthestrike.com

Today we’ll be diving into the tastyworks mobile app to learn all about how to automate a bit of our trading. This is through the use of One-Cancels-Other, or OCO Bracket orders. Today we'll learn all about how to place OCO bracket orders on the Tastyworks Mobile App. This allows us the ability to automate both our profit target and stop loss for the position. We’ll quickly learn how to place this on one of our current positions, then as part of a brand new trade, and even how to do it on an option contract as well.

How to Short Stock on Tastyworks Mobile App

10 views · Dec 16, 2022 shortthestrike.com

Today we'll learn how to short stock on the Tastyworks Mobile App. We'll go through the entire process of opening and closing a short position every step of the way. Shorting stock is a risky, but potentially profitable way to make money from a stock going down in value. It is essentially borrowing stock from your broker, then selling those shares in the market. At a later date, you’re then hoping to buy those shares back at a lower price and profit the difference. Just be careful if you’re just getting started and stay small so you don’t get yourself in too much trouble. There is literally unlimited risk potential to the upside, so be sure learn everything possible before incorporating this in your own trading.