Trading Futures Options on ThinkorSwim

3K views · Dec 19, 2022 shortthestrike.com

Today we’ll be diving into the thinkorswim platform to learn all about futures options and how to trade them. Before you even think about trading futures options, you should already have a good understanding of both standard equity options and futures already. In terms of similarities to regular equity options, a futures option gives you the right to buy or sell the underlying future at a set price, for a set amount of time. But that’s pretty much where the similarities end. Unlike equity options (which are standardized), futures options are not. Meaning they don’t necessarily all expire at the same time of day, and they may have different multipliers than one another.

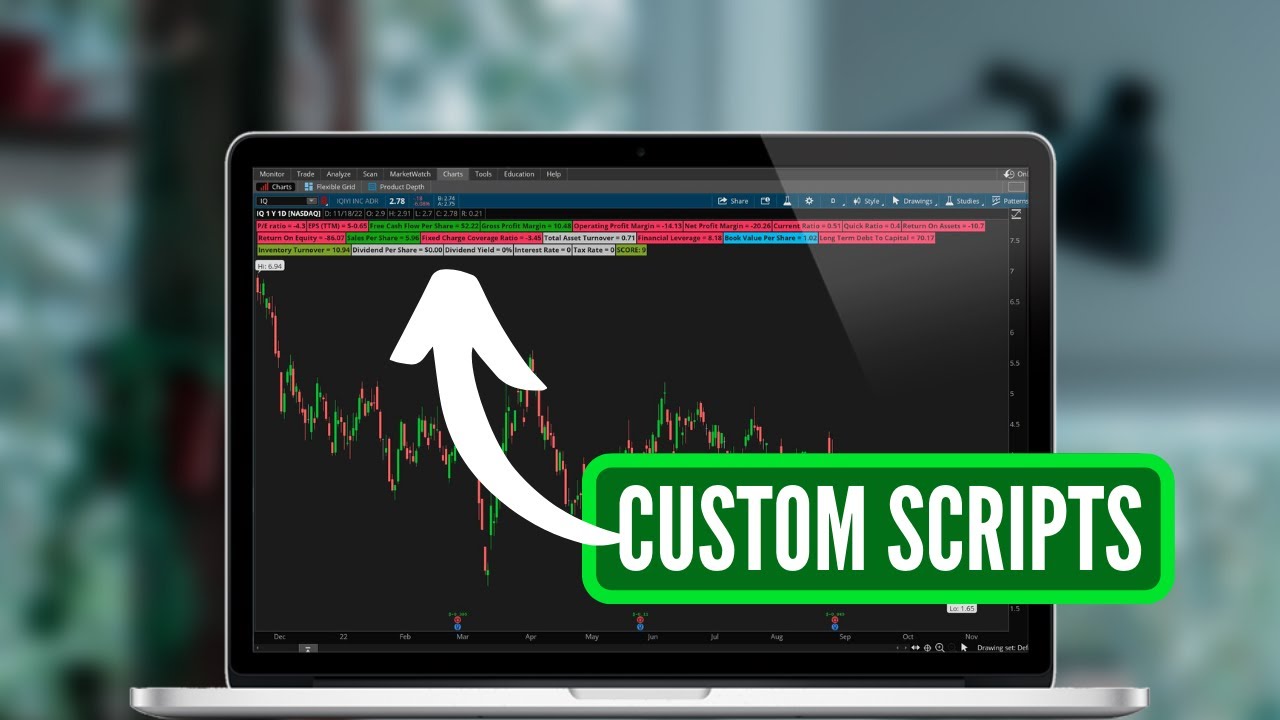

21 FREE Fundamentals You Need For ThinkorSwim | Custom Think...

4K views · Dec 19, 2022 shortthestrike.com

Today we’ll be adding a custom thinkscript to display 21 different financial ratios directly to our charts. Despite thinkorswim being a platform mainly geared towards active traders, it still has at least some financial data that we can use to make more informed investments. This would include information such as: PE Ratio, Debt to Assets, Earnings Per Share, Dividend Yield, and much more. The script in this video allows you to display all of this information directly on your thinkorswim charts and even customize them how you see fit.

Buy and Sell Options Using Stock Price on ThinkorSwim Mobile...

117 views · Dec 19, 2022 shortthestrike.com

Today we'll learn how to place options trades using the underlying stock price as the trigger. We’ll be placing a few different options trades using the underlying stock price as a trigger. We’ll do this to open a brand new option position, so essentially buying an option, and then after that we’ll set a stop loss on that same option using the stock price as our trigger. Timestamps 0:00 Intro 1:19 Purchase option contract 2:59 Create a condition using stock price 8:36 Attach stop loss order 9:08 Set stop on option using stock price 11:51 Cancel or edit working order 12:03 Outro -------------------------------------------------- You should not treat any opinion expressed on this YouTube channel as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Opinions expressed are based upon information considered reliable, but this YouTube channel does not warrant its completeness or accuracy, and it should not be relied upon as such. This YouTube channel is not under any obligation to update or correct any information provided in these videos or their descriptions. Statements and opinions are subject to change without notice. Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

ThinkorSwim Web Options Trading Tutorial

3K views · Dec 19, 2022 shortthestrike.com

Today we'll learn how to buy and sell options within the thinkorswim website, also known as TOS Web. ThinkorSwim is an incredibly powerful trading platform filled with tools, features, and customizations. All of these trading tools are incredibly useful, but can also be prove overwhelming for those brand new to investing. Recently, thinkorswim has come out with a web based platform called thinkorswim web. This platform is far simpler to learn, while still maintaining all the most important aspects of the thinkorswim desktop. Today we'll be diving into the trade.thinkorswim.com website to learn how to buy and sell options contracts, manage open positions, and create more advanced orders.

ThinkorSwim Web OCO Bracket Order Tutorial (Step-by-Step Tut...

3K views · Dec 19, 2022 shortthestrike.com

Today we'll learn how to place OCO bracket orders on the thinkorswim web app. Advanced orders are one of the simplest forms of automation and a way to place multiple orders all at the same time. Today we’ll be specifically discussing an advanced order known as OCO bracket orders, we’ll learn how to place them, and also how to manage them within the thinkorswim web app. For those of you unfamiliar with this type of trade, an OCO order or one-cancels-other order can be used to close out a position at a either a set profit target or at predefined stop price. Because this would require two separate orders working simultaneously, the OCO would allow you to place both of these at the same time and whichever order happens to fill first, the other would be cancelled automatically.

How To Add Studies and Customize Charts | ThinkorSwim

4K views · Dec 17, 2022 shortthestrike.com

This video will show you how to add studies and customize charts on the ThinkorSwim platform. It will also cover how to create drawings, adjust time frames, and add multiple charts within ThinkorSwim. ThinkorSwim is one of the best platforms out there for traders and some of the best charts available. Nearly everything within their platform is customizable, including their charts and indicators.

How To Scan for Stocks | Stock Hacker | ThinkorSwim

4K views · Dec 17, 2022 shortthestrike.com

Finding stock that meet your criteria can be a difficult task. However, with the scan tab on ThinkorSwim this is made far easier. Traders can use the scan tab to filter results based on price, market cap, earning per share, and various study criteria. Setting up the scan tab will take some time when you're first getting started but can save you countless hours later down the line. End Screen: Song: Unknown Brain & Kyle Reynolds - I'm Sorry Mom [NCS Release] Music provided by NoCopyrightSounds Free Download/Stream: http://ncs.io/ImSorryMom Watch: http://youtu.be/-owvY5f3mCA

How To Buy & Sell Stock | ThinkorSwim

6K views · Dec 17, 2022 shortthestrike.com

Trading in ThinkorSwim can be a bit confusing when you're first getting started. In this video you'll learn how to buy stock, sell stock and close out of your open positions. ThinkorSwim is one of the best trading platforms currently available. It allows traders to buy and sell stock, options, futures, and forex. ThinkorSwim is also incredibly customizable with nearly every tool and feature being editable in someway.

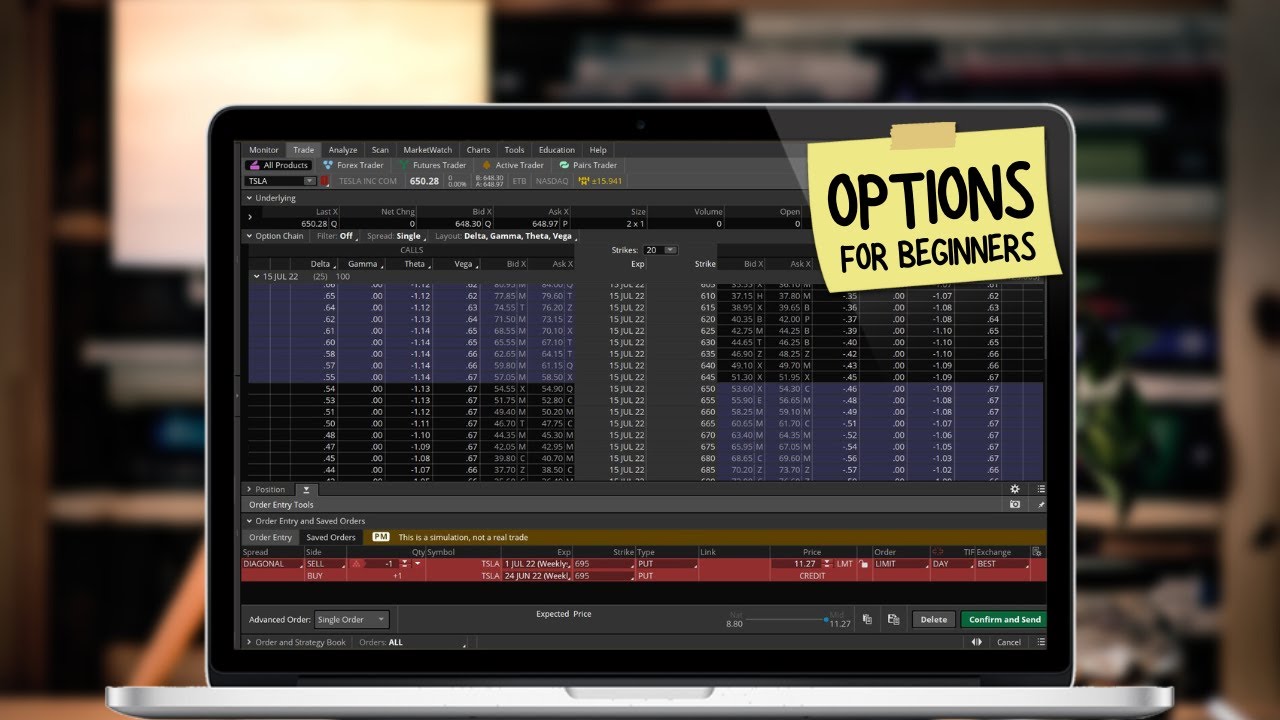

How to Trade Options on ThinkorSwim (Step by Step) | Beginn...

3K views · Dec 17, 2022 shortthestrike.com

In this ThinkorSwim tutorial video we'll be covering how to trade options within the platform. This will cover how to buy and sell single leg options, create spreads, and close out of your open option positions. If you have any suggestions for topics you'd like me to cover, please leave them down below in the comments! End Screen: Song: Unknown Brain & Kyle Reynolds - I'm Sorry Mom [NCS Release] Music provided by NoCopyrightSounds Free Download/Stream: http://ncs.io/ImSorryMom Watch: http://youtu.be/-owvY5f3mCA

Active Trader Tutorial for Beginners | ThinkorSwim (Best too...

11K views · Dec 17, 2022 shortthestrike.com

The active trader tool on ThinkorSwim is mainly used by Day Traders and scalpers. It's by far the quickest way to trade in and out of stock and futures. In this video we cover every aspect of the Active Trader ladder and the many ways to place a trade through the tool. You have the ability to create market orders, limits, stops, and trailing stop orders with a single click of the mouse. You also have the ability to create bracket orders, OCO orders, by customizing the template within the active trader. It's an incredibly powerful tool that allows you to quickly trade stock, options, or futures. End Screen: Song: Unknown Brain & Kyle Reynolds - I'm Sorry Mom [NCS Release] Music provided by NoCopyrightSounds Free Download/Stream: http://ncs.io/ImSorryMom Watch: http://youtu.be/-owvY5f3mCA

How To Group Symbols |ThinkorSwim

759 views · Dec 17, 2022 shortthestrike.com

Once you begin to trade more actively, the number of positions in your account will begin to grow. Your screen will eventually be cluttered with a variety of products making it difficult for you to track. Grouping symbols within the Activity and Positions page in ThinkorSwim can make it far easier to monitor and manage your open positions. You can group symbols by sector, type, or by account. You can also create your own groups for your options positions, stock positions, and futures positions.

How To Create Advanced Orders | OCO Bracket | ThinkorSwim

635 views · Dec 17, 2022 shortthestrike.com

Learn how to create a OCO bracket order in ThinkorSwim. This video also covers the other advanced order options and the method of saving an order template for future use.

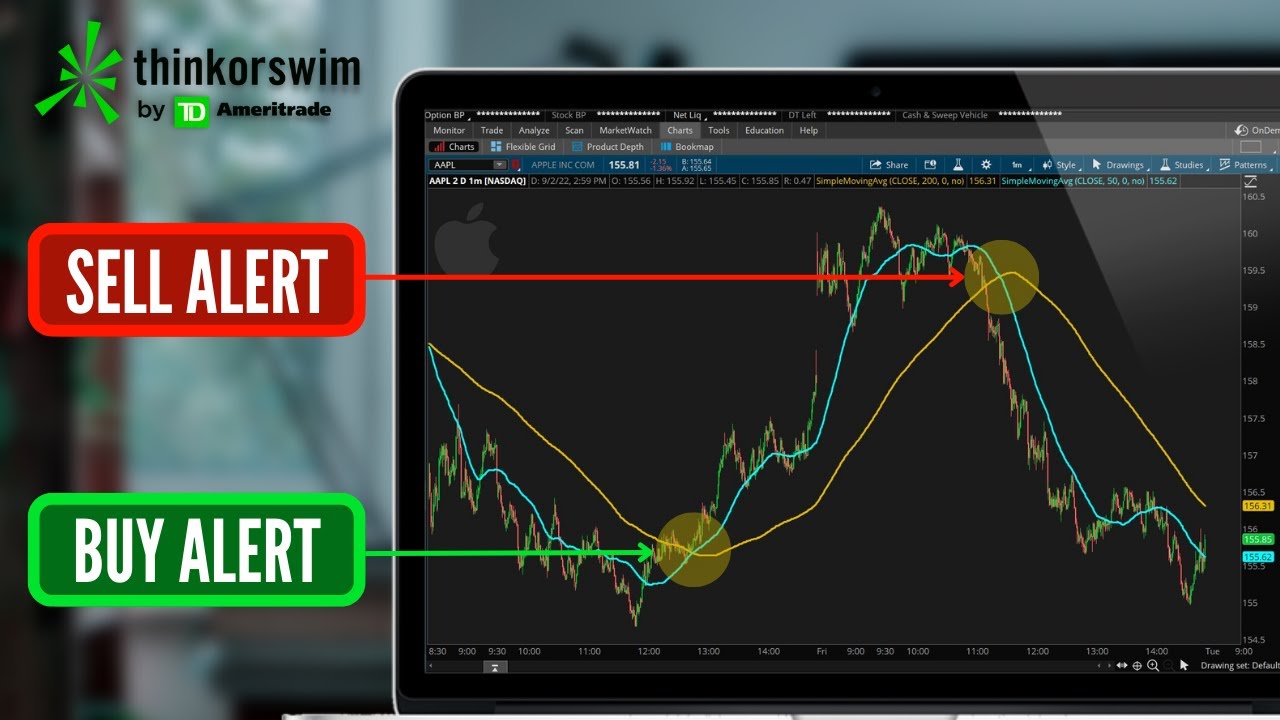

How to Create Alerts | ThinkorSwim | Basic alerts and study ...

7K views · Dec 17, 2022 shortthestrike.com

This video will go step by step in creating alerts within ThinkorSwim. I will cover how to create basic alerts based off of stock price, alerts based off of technical indicators like RSI, and portfolio alerts. If you found this video helpful, please like and subscribe! End Screen: Song: Unknown Brain & Kyle Reynolds - I'm Sorry Mom [NCS Release] Music provided by NoCopyrightSounds Free Download/Stream: http://ncs.io/ImSorryMom Watch: http://youtu.be/-owvY5f3mCA

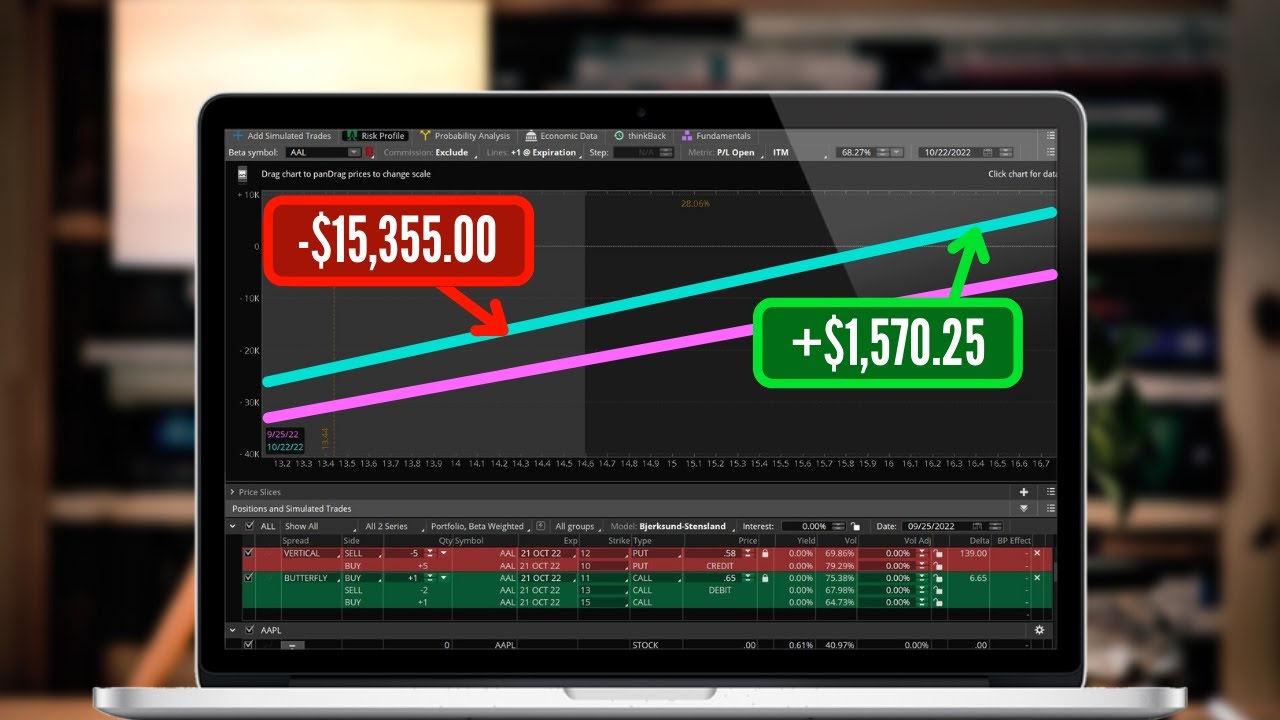

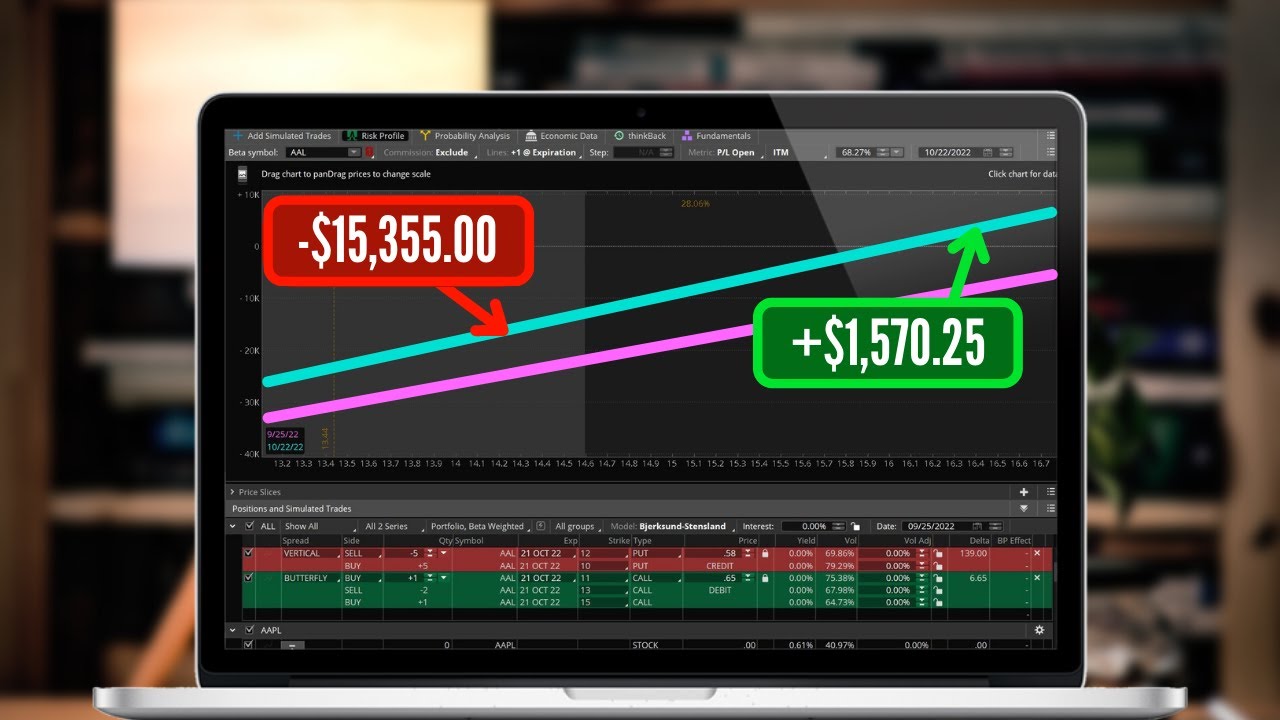

How to Analyze Trades on ThinkorSwim I Risk/Profile for Begi...

9K views · Dec 17, 2022 shortthestrike.com

The risk/profile page within ThinkorSwim allows you to analyze the risk on your positions as well as hypothetical trades you're considering putting on. It gives you a visual representation of exactly how you will make or lose money on a give trade. Within the tab you can adjust inputs like stock price, time, and volatility to uncover your resulting profit/loss on the trade. You can also manage your position greeks and analyze the effect of a new trade before putting it on.

How to Create Trailing Stops on ThinkorSwim I Step-by-Step T...

1K views · Dec 17, 2022 shortthestrike.com

In this video we go step-by-step to create a trailing stop order within the ThinkorSwim platform. We cover how to create the trailing stop using percentage, dollar, and tick offsets. Thanks for watching! End Screen: Song: Unknown Brain & Kyle Reynolds - I'm Sorry Mom [NCS Release] Music provided by NoCopyrightSounds Free Download/Stream: http://ncs.io/ImSorryMom Watch: http://youtu.be/-owvY5f3mCA

How to Use Earnings Tab on ThinkorSwim I Using Volatility to...

4K views · Dec 17, 2022 shortthestrike.com

In this video we cover the earnings page on the ThinkorSwim platform. The earnings page provides a wealth of information including the price history, implied volatility, the price of the at-the-money straddle, and the actual vs expected earnings. This gives traders a quick snapshot of the previous eight quarters of earnings and get a better understanding of volatility expansion/contraction going into and coming out of an earnings announcement.

How to Create Portfolio Alerts in ThinkorSwim | Simple Step-...

8K views · Dec 17, 2022 shortthestrike.com

This is a step-by-step tutorial on how to create portfolio alerts within the ThinkorSwim Platform. Portfolio alerts can be created on metrics like account value, Net Liquidity changes, portfolio delta, and many more. Similarly, you can also create alerts to notify you if any news articles are published about those companies in your watchlists or any calendar events like dividends and earnings. I hope this video helps! Risk Disclosure: All streams and videos are for educational purposes only and the opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account End Screen: Song: Unknown Brain & Kyle Reynolds - I'm Sorry Mom [NCS Release] Music provided by NoCopyrightSounds Free Download/Stream: http://ncs.io/ImSorryMom Watch: http://youtu.be/-owvY5f3mCA

ThinkorSwim Tutorial for Beginners 2022 |Step-by-Step Guide ...

3K views · Dec 17, 2022 shortthestrike.com

This is a basic tutorial of the 2021 version of TD Ameritrade ThinkorSwim Platform. ThinkorSwim is one of the best platforms out there for those planning to trade stock, options, futures, or forex. This tutorial will show you everything you could possibly need to know to get started trading on ThinkorSwim. We’ll discuss how to buy and sell stock, trade options, view charts, and some general customization. We’ll also go over how to create spreads like verticals and Iron Condors. If you have any questions about ThinkorSwim, options, investing, or real estate; Please let me know in the comments down below.

ThinkorSwim Mobile App Tutorial for Beginners 2023 |Step-by-...

5K views · Dec 17, 2022 shortthestrike.com

ThinkorSwim Mobile Demo for Beginners 2023 In todays video we do a full demo of the ThinkorSwim mobile app. We cover everything you’ll need to know to get started trading on the app. Everything from how to place a trade, customize charts and view balances. The ThinkorSwim mobile app is just one of the apps offered by TD Ameritrade. However, it is the recommended trading app for those of you active traders out there. Although I still prefer to do most of my trading from the Desktop application of ThinkorSwim, the TOS app is an excellent alternative. For those of you switching from Robinhood, this app will take some time getting used to, but it’s well worth the time to learn. You’re going to be able to easily access Level II data, view studies and indicators on your charts and trade complex products far more easily. If you’re an options trader this is also the app for you. When viewing the option chain you can add any metric you find important when picking your strikes. Whether that be any of the greeks (delta, gamma, theta, vega), volume, probability OTM, or many more. It will also allow you to place more complex options spreads like Iron Condors or butterfly spreads far more quickly. It is also the only app through TD Ameritrade that will allow you to trade products like futures or forex.

How to Place Conditional Orders on ThinkorSwim |Automate you...

4K views · Dec 17, 2022 shortthestrike.com

How to Place Conditional Orders on ThinkorSwim |Automate your Trading In todays video we’ll be going through all the steps needed to create a conditional order on ThinkorSwim. Conditional orders allow you to create far more complex orders and somewhat automate your trading. It allows you to set parameters that need to be met before an order is submitted. This could be based on simple things like stock price or time. They could also be far more complex, based off technical indicators or fundamentals. Many options traders will also utilize conditional orders in order to place opening/closing orders on their options but base the price on the underlying stock. Many times this would be used if a trader has a buy/sell target but this is based off the stocks support and resistance rather than the option contract itself. In this video we’ll go step-by-step through entering stops on options based off the stock price. We’re going to go through each of these, but if you want to skip to a certain type of conditional order – check out the time stamps down below.

Account Info on ThinkorSwim Explained | Buying Power, Cash, ...

2K views · Dec 17, 2022 shortthestrike.com

In this video we explain the meaning behind numbers displayed in the account info section, cover how to customize the gadget, and hide balances. If you’d rather read what each value represents, check out the description below. Net Liq and Day Trades: This is the actual value of your account. This includes all of your investments and cash. Basically, if you were to close out of all the positions in your account at their current prices, this is how much you would be able to take out in cash. Cash & Sweep Vehicle: Cash and sweep is the amount of cash you actually have in the account currently. If it’s a positive number, that’s how much you have to spend without borrowing a single penny on margin. If cash and sweep is a negative number, that is your current margin balance. Option Buying Power: This is the amount of money you can spend on non marginable securities. Things like options, penny stocks, or really volatile stocks that your brokerage has put a 100% maintenance requirement. At the time of making this video, that would be stock like AMC or Gamestop. Stock Buying Power: This is the amount of money you have to spend on fully marginable stock. Think of stock like Apple, Netflix or Microsoft. Now keep in mind, if you spend beyond your cash that would mean dipping into margin. Although it says I currently have 200k in stock buying power, if I were to buy $150,000 of apple stock, my cash and sweep would immediately show negative $50,000. If you want to avoid borrowing on margin, you need to keep an eye on your cash and sweep not your stock buying power. Lastly, day trades left simply shows you how many day trades you have remaining until you’re flagged as a patter day trader. This will only apply to you if you’re trading in a margin account and will only negatively impact you if you have less than $25,000 in the account. If you have a cash account, you can remove this from your account info section entirely.

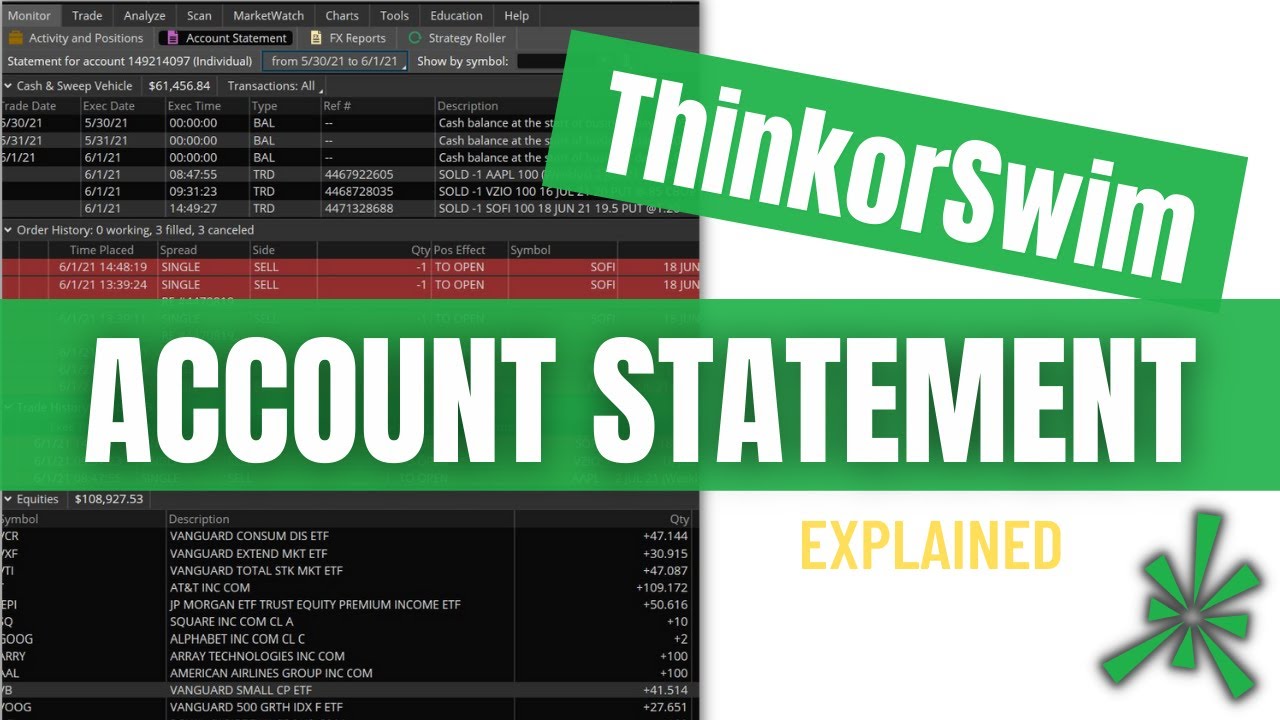

Account Statement on ThinkorSwim | Step-by-Step 2023

26K views · Dec 17, 2022 shortthestrike.com

Learn how to view your transactions, options assignments, track dividends, order history, and order history on the Account Statement page on ThinkorSwim. The Account Statement page on ThinkorSwim is typically used to view the historical activity on your account. The Cash & Sweep Vehicle page allows you to track all the recent transaction in the account. This includes things like dividends, trades, cash deposits, or options assignments. This page also allows you to view the resulting cash balance after the transaction. The Order History and Trade History pages allow you to view all the past trades place and filled within the account. The order history tab shows all trades, regardless of whether they have filled or not. The date and time visible will be the time the order was placed, not when it filled (if the order did fill). The trade history tab will only show filled trades within the account. The date/time you see on the order ticket will be the actual fill time and the price seen on the right will be the actual fill price. The Equities and Options tabs will allow you view the current and historical positions in your account. The time can be adjusted to view historical positions, their trade price, and the market price at the time selected. The profit & loss section will display the P/L in the account for either the time selected or the year.

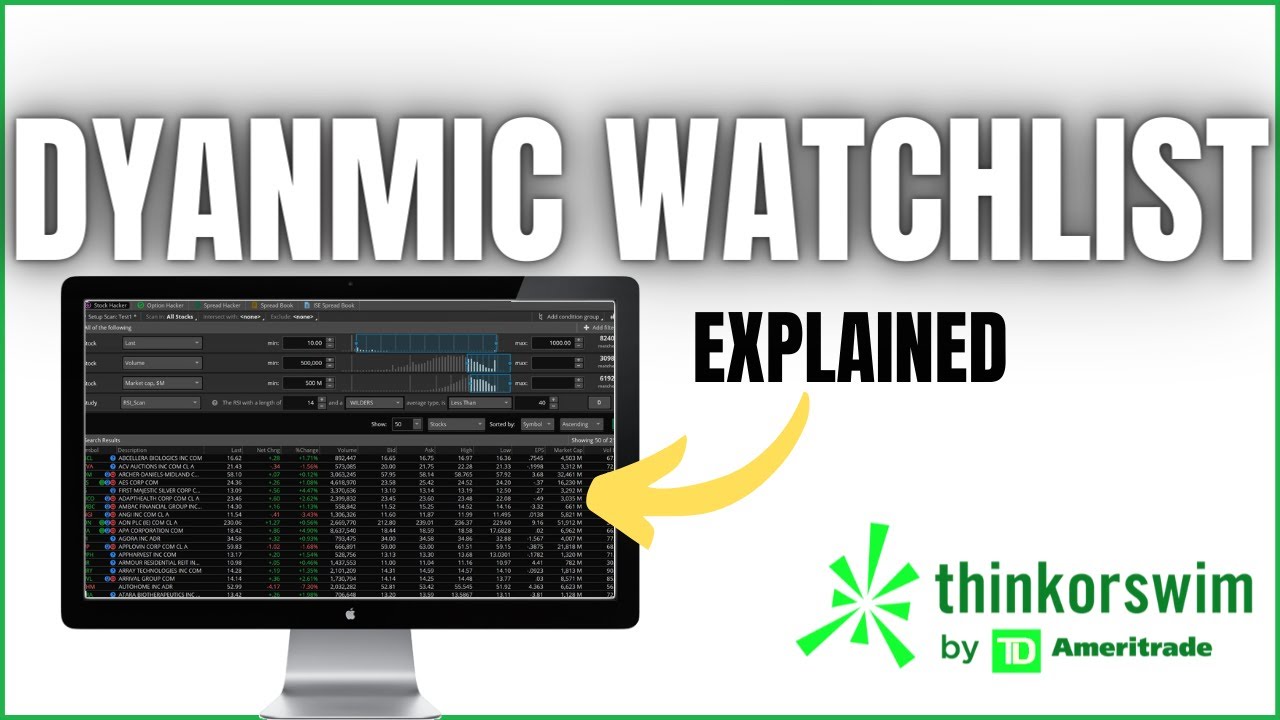

How to Create a Dynamic Watchlist in ThinkorSwim

2K views · Dec 17, 2022 shortthestrike.com

Learn to create and customize a dynamic watchlist within ThinkorSwim. Dynamic watchlists or scanners watchlists create a custom watchlist of companies to assist you in finding stock to trade on a daily basis. Dynamic watchlists are used to scan through the thousands of companies in the market and narrow it down to only those stock that meet our criteria. These filters can be based on simple things like stock price or volume. We can also create fundamental filters based on things like cash flow ratio, current ratio, or PE. If you’re a technical trader we can also create study or pattern filters. Creating a scan looking for macd crossovers or stocks that are oversold on the RSI. Once you get a bit of experience with the scan tab, you can search for practically anything. Once you create the scan you’ll need to save it and it will automatically populate in your personal list of watchlists. This watchlist will update itself every 3-4 minutes, only displaying those stock that match your criteria at that time.

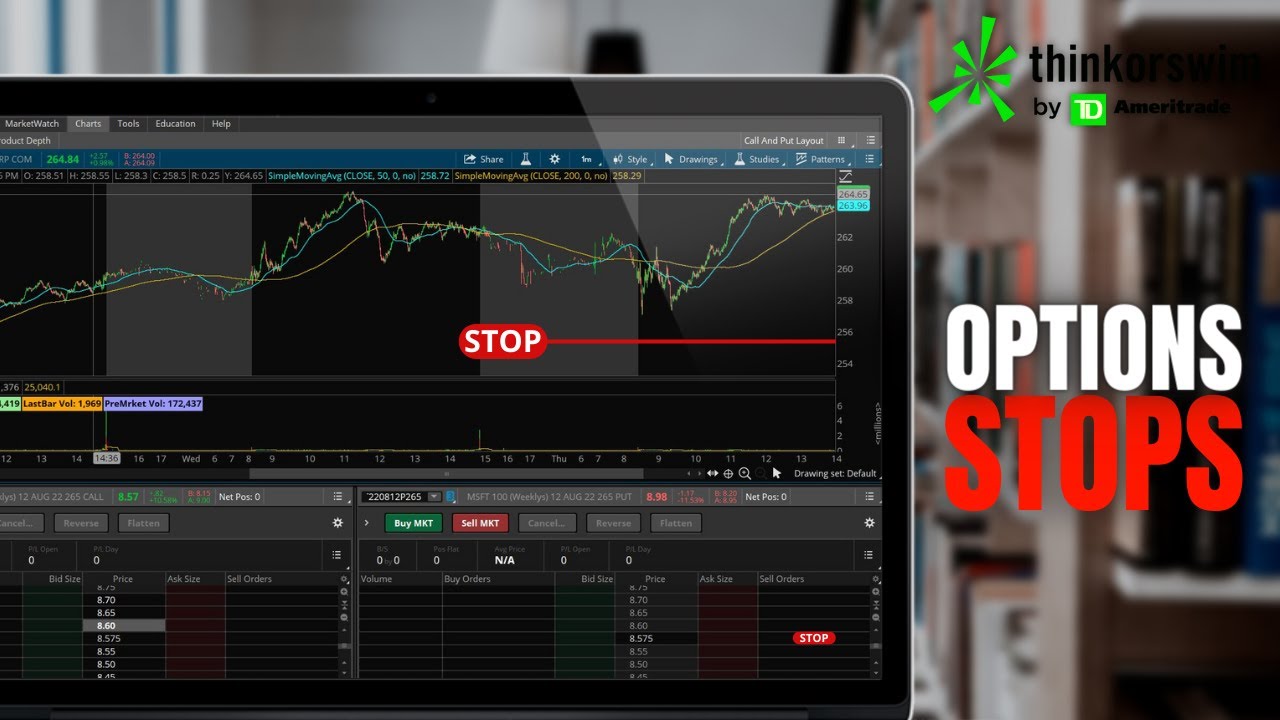

How to Create a Bracket Orders on Options in ThinkorSwim |Ad...

9K views · Dec 17, 2022 shortthestrike.com

This video will go step-by-step through creating stops and bracket orders on options. We’ll go through several methods to create stops/OCO orders as well as discuss why you may want to be careful when using stops on options. OCO bracket orders (One cancels other) allow you to place both a profit target as well as a stop on your particular option. These will typically be used for individual stocks, but can be used on options contracts as well. Due to the wide bid/ask spreads at times on options you need to much more careful when using these advanced orders.

How to Trade After Hours on ThinkorSwim

6K views · Dec 17, 2022 shortthestrike.com

In this video we learn how to trade stock in the after hours, premarket and post market trading hours, and things you’ll want to look out for when trading during these hours. The trading hours available will depend on the individual brokerage you trade with, but most will offer pre-market trading at 7:00 AM EST and the post-market until 8:00 PM EST. The only brokerage firm I’m aware of that offers trading times earlier than this is WeBull. Webull offers pre-market trading as early as 4:00 AM EST. To trade in the after hours in ThinkorSwim you simply need to make a couple slight adjustments to your order ticket. First, the order must be a limit order where you specify a price. Limit orders are the only order type accepted in the after hours. The only other adjustment would be to change the TIF (Time in Force) to either EXT or GTC EXT. An order marked EXT (Extended Session) will be active from 7:00 AM – 8:00 PM EST. If the order does not fill by 8:00 PM the order will cancel itself. If the order is marked GTC EXT (Good Till Canceled Plus Extended) it will be active from 7:00 AM – 8:00 PM EST everyday until it either fills or you cancel it. The only thing you need to be careful with in the premarket/post market is the liquidity of the stock you’re trading. In the after hours, liquidity can really dry up. This will make it difficult to enter or exit at a fair price. However, if you’re trying to trade earnings or a news announcements, the ability to trade in the after hours can be vital for you.

Trade Options Fast Using Active Trader on ThinkorSwim

8K views · Dec 17, 2022 shortthestrike.com

In this video we’re going to learn how to trade options using the active trader on ThinkorSwim. This video will walk you through opening an options chart, adding the active trader, and go through all the steps needed to actually place trades. I’ll also briefly touch on some of the advanced tools inside the active trader that could be helpful later down the line. These tools include creating order templates, utilizing auto send, saving order templates for future use. There are many examples throughout the video to get you comfortable using the active trader to trade options more quickly. We’re also going go through customizing the chart layout to make it conducive for options trading.

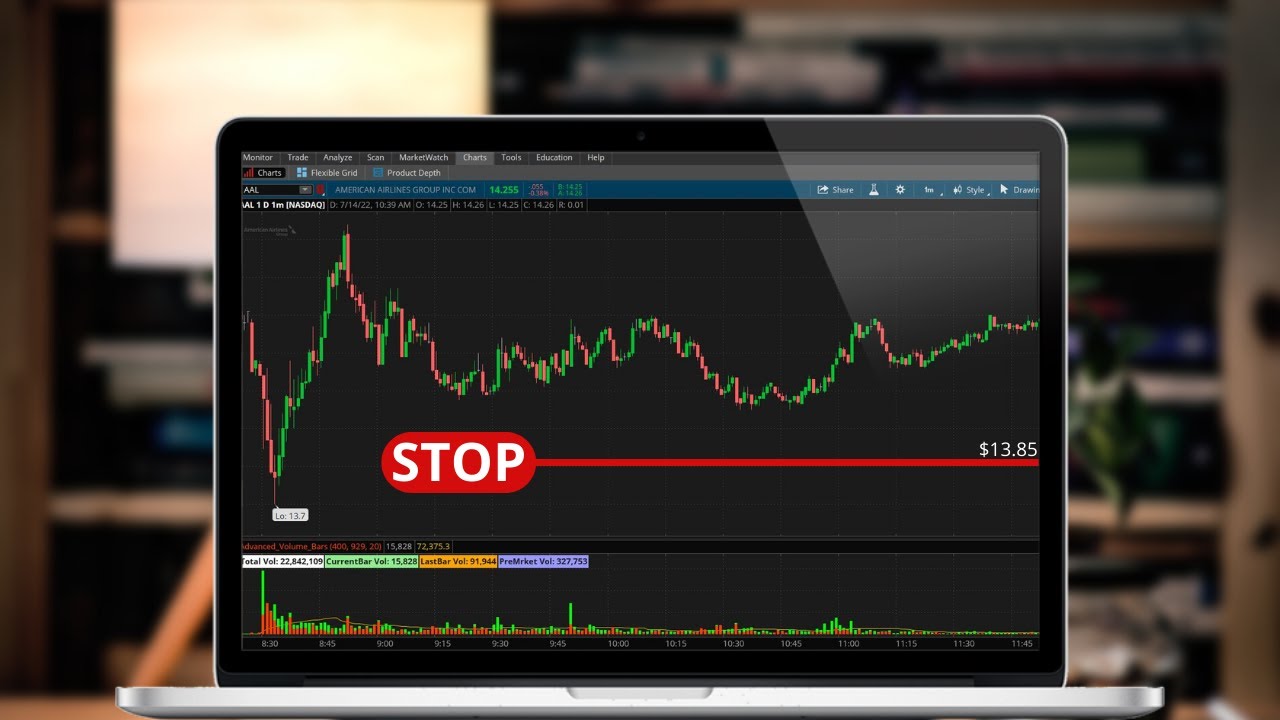

How to Create a Stop on ThinkorSwim

4K views · Dec 17, 2022 shortthestrike.com

In this video we’ll be learning how to place stops on the thinkorswim platform. There are many different ways to place stops in the ThinkorSwim platform, but in this video we’ll cover three of the most popular methods. One way stops can be placed in ThinkorSwim on open positions is through the monitor page. From here you would simply need to right click on the stock you want to place the stop on - create a closing order - with a stop. This would then take you to an order ticket where you can adjust the number of shares, the stop activation price, and the time in force for the order. You can also place the stop on a position you don’t yet own. This basically means you are first creating an order to buy a stock at which time a stop would then be triggered to be sent out automatically. This can be done many different ways, but in this video we do it from the trade page as well as through the active trader.

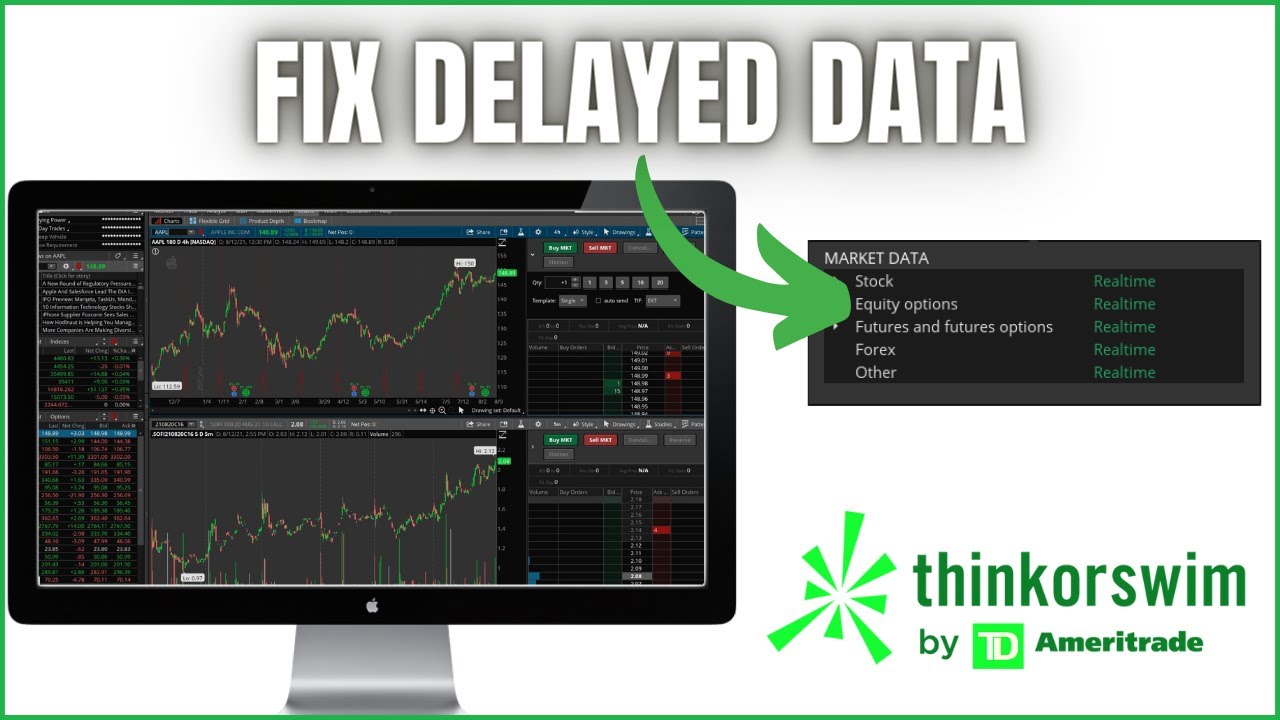

Fix Delayed Data and Level II Quotes on ThinkorSwim | Get Re...

4K views · Dec 17, 2022 shortthestrike.com

In this video we’ll quickly show you how to fix your delayed data on ThinkorSwim and enable realtime quotes. We’ll also cover how to subscribe for realtime level II quotes for free. In order to fix the delayed quotes you will need to login to your TD Ameritrade account. You will then navigate to Client Services - My Profile - General. From the general page you need to find and sign the exchange agreements. Once the agreements are signed, you will immediately see realtime quotes on the ThinkorSwim platform. In order to enable realtime level 2 quotes you will need to find the subscriptions page and subscribe to NASDAQ Level II quotes. Once done you'll be able to see level 2 on both ThinkorSwim and TD Ameritrade.

How to Place a Stop Loss in ThinkorSwim Mobile App

2K views · Dec 17, 2022 shortthestrike.com

In this video we’ll go step-by-step on how to place a stop loss order in the ThinkorSwim Mobile App. We’ll go through the process of placing a stop order on a position you already hold, as well as how to place a stop along with your opening order. This would technically be an advanced order or first trigger sequence order. Basically, the stop order will not be entered until the opening order to buy the stock first fills.

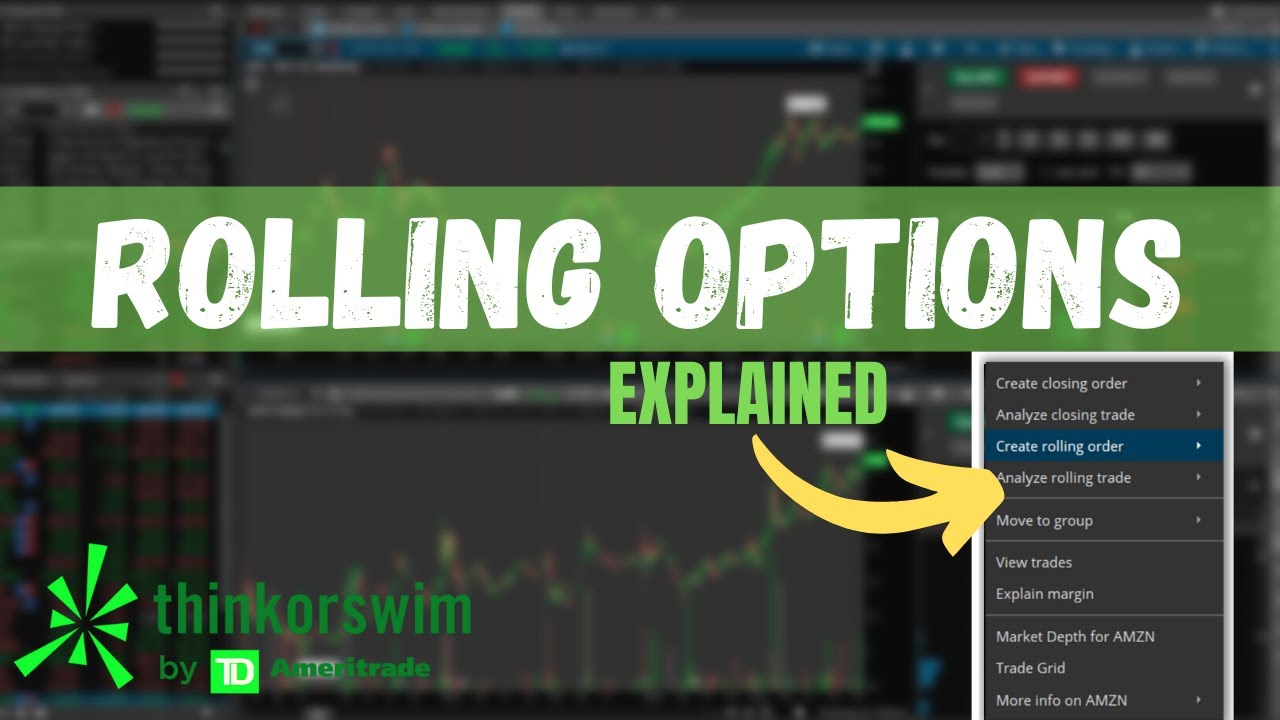

How to Roll Options on ThinkorSwim | Step-by-Step Tutorial

561 views · Dec 17, 2022 shortthestrike.com

In the video today we’ll be going through all the steps needed to roll options in the ThinkorSwim platform. Throughout this video we’ll go through creating a rolling order step-by-step on the ThinkorSwim platform. The process is relatively simple, but there are several things you’ll need to consider when making the roll. We’ll also go through creating a rolling order on both single leg options and spreads. Rolling a single leg or a spread is a nearly identical process, however there are few considerations you’ll have to take before making the roll. Keep in mind, the maximum number of legs you are able to roll is 4. Meaning you not be able to roll iron condors, jade lizards, etc.. If you intent to roll a spread with more than four legs, you will need to break up the order. After creating the roll, you’ll need to then select the expiration and strike you intend to roll to. Generally, when rolling out a short option, you would only consider doing the roll for a credit. When paying for the roll (doing it for a debit) this means you are increasing your max risk and reducing your max profit. Generally, doesn’t make much sense to do this unless you’ r moving the probabilities in your favor significantly.

Drawing Tools for Beginners in ThinkorSwim

9K views · Dec 17, 2022 shortthestrike.com

In this video we’ll go through all the drawing tools on ThinkorSwim, learn how to create drawing templates and create shortcuts to the drawing tool itself. ThinkorSwim has a wide range of drawing tools available for trade to use and incorporate into their trading. In this ThinkorSwim tutorial we will cover each of these drawing tools available to you. We’ll also go through creating shortcuts to access the drawing tools quicker as well as saving templates to save you time creating future drawings. On ThinkorSwim you have the ability to access the drawing tools in many ways. My favorite, and by far the simplest, is by simply clicking on the scroll wheel like it’s a button. After clicking the scroll wheel the drawing tool will automatically populate next to your mouse. From there you can simply access the drawing tool you wish to use. My second favorite method would be pinning the drawing tools to the top of your chart. If you were not already aware, in ThinkorSwim you have the ability to pin tools to the top of the chart that you access often. This could include saved styles, studies, and drawing tools. In this video we’ll go through all the steps needed in order for you to pin your drawing tools to the top of your chart. Throughout the video we will also discuss each drawing tool available individually. These drawing tools include the pan tool, pointer, trendline, price level, shapes, regression lines, and fibonacci’s. These more advanced drawings, like fibonacci’s, can be customized according to the values you find most valuable. Lastly, we’ll discuss how to delete drawings from your charts as well as save those drawing as drawing sets. Drawing sets will allow you to save previous drawings and quickly access them again if previously deleted. Drawing sets allow you to save drawings you’d like the ability to access but do not want to view them at all times.

ThinkorSwim Web Tutorial for Beginners | TOS Web

3K views · Dec 17, 2022 shortthestrike.com

In this video we’ll go through a step-by-step tutorial of ThinkorSwim Web. TOS web is the online version of ThinkorSwim and allows you to place trades, views charts, and analyze trades without having to download the desktop version of the platform. ThinkorSwim web is a fantastic alternative to the ThinkorSwim desktop platform. If you’re familiar with the mobile version of TOS, you find many similarities. Like ThinkorSwim desktop, ThinkorSwim web allows you to trade stock, options, futures, and forex. You also have the ability to view charts, add studies or technical indicators, and analyze hypothetical trades to view your risk profile. This video will go step-by-step through everything you’ll need to know to get started with ThinkorSwim web. Its important to keep in mind that this is a much more simplified version of ThinkorSwim. You will not have access to all the tools or functionality, but many of you may find this more appealing to the traditional desktop app.

Scanning for High Volatility Stocks | ThinkorSwim Stock Hack...

3K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to scan for high volatility stocks using the stock hacker in ThinkorSwim. This scan we’ll be mainly geared towards options sellers trying to find stock with high volatility to sell premium against. As an option seller, I am often trying to find stock that have high IV and ideally, stock towards the upper end range of IV rank. The higher the implied volatility (IV) for a stock, the higher the premiums are for the options contracts. As options sellers, we’re typically trying to pull in as much premium as possible. In this video we’ll be trying to create a short list of companies that pay significantly more premium than other underlying’s and attempt to puts volatility contraction on our side. Creating a scan for high volatility can save you time and deliver a short list of companies that match your criteria. You can also expand on this scan by adding fundamental filters or anything else you find important to refine this list further. In this video we’ll specifically go through adding a scan for Implied volatility, IV rank, Implied volatility vs historical volatility, and some additional stock filters to narrow this list down to more liquid underlying’s. This will all be done through the stock hacker on ThinkorSwim.

Scan for Unusual Options Activity in ThinkorSwim

940 views · Dec 17, 2022 shortthestrike.com

In this video we’ll learn how to scan for unusual options activity within the ThinkorSwim platform. We’ll also touch on how you can incorporate trade flash to quickly see large options trades, news announcements, and much more. Timestamps 0:00 Intro 0:16 Trade Flash 5:35 Unusual Options Activity Scan The trade flash gadget is the simplest way to find unusual options activity within the thinkorswim platform. You simply need to add it to your side panel and it will display any large options activity throughout the market. You’ll be able to see both long and short options trades, quickly tell if they were apart of a spread, then do your own diligence from there. You also have the ability to create your own custom scan for unusual options activity through the scan tab. In this video we’ll be creating scan for options that have at least 2,500 contracts traded today, the volume is greater than the open interest (tends to suggest the trading volume is exceptionally high today) and we’ll then throw in the call/put sizzle index to find the most active underlying’s. ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

OnDemand for Beginners | ThinkorSwim Tutorial

3K views · Dec 17, 2022 shortthestrike.com

In this video we’ll be discussing the OnDemand tab within ThinkorSwim. OnDemand allows you to manually backtest your strategies, find historical data, and practice your trading when the market it closed. Although OnDemand allows you to place simulated trades (PaperMoney) you will need to be logged into your live account to access the tool. Once logged in you simply need to click on “OnDemand” in the upper right hand corner of the platform to access the tool. From there you can then select a specific day and specific time to go back in time. The platform will then update all quoting information as if it was that day at that exact time. ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Thinkback Backtesting Explained | ThinkorSwim

4K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll be going through the thinkback tab on the thinkorswim platform. If you haven’t used it before, thinkback allows you to manually backtest your trades and quickly see how they would have played out over time. You can analyze hypothetical trades, view historical pricing, and see when the most opportune time would have been to close your positions. You can backtest both stock and options strategies. ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Cash Secured Put Scan in Thinkorswim

4K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll be going through a few different ways we can set up our scanners to find some cash secured puts to sell. It’s important to remember there are a ton of different ways we can set this up. We can set up simple scan looking for more volatile stocks towards their upper end range of volatility and have weekly options. We could scan for fundamentals we find important, like PE ratio, cash flow ratio, dividend yield, pretty much anything. In the scan today we’re going to be searching for options expiring 20 to 60 days out, have a bid greater than 0.25, have a return on risk greater than 5%, have implied volatility greater than 40% and the IV Rank is greater than 20%. Towards the end of the video, we also go over how to adjust the scan to search for weekly options with earnings coming up. Hopefully, this helps to find some earnings plays in the next week that match your scan criteria. If you have any questions about creating your own scanner to search for cash secured puts to sell, please leave them down below in the comments! ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Setup Multiple Charts on ThinkorSwim

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll be covering how to view multiple charts within thinkorswim, create multiple different chart templates and how to detach the charts to view them on multiple different monitors. Timestamps 0:00 Intro 0:36 Creating Multiple Charts 4:20 Adding Charts to Flexible Grid 6:20 Saving Chart Templates 8:24 Detaching Charts for Multiple Monitors Throughout this video we delve into adding and customizing multiple different chart layouts on both the charts tab and flexible grid tab. The process is very similar between the two, but there are some slight differences. It’s important to keep in mind that they both allow you to view stock charts, level II data, time & sales, new, and much, much more. However, the flexible grid gives you more control with the sizing and location for these additional charts/gadgets. Whereas the charts tab is much more symmetrical. You’ll also learn how to save your chart layouts and quickly access them in the future. Once you start using this platform actively, you’ll very likely have multiple different chart types, study sets, and layouts you’ll want to be able to flip between quickly. We’ll also cover how to detach the charts and grids and move them to your other monitors. ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Create OCO Bracket Orders on the ThinkorSwim Mobile A...

1K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll be discussing how to create advanced orders, specifically OCO bracket orders, on the ThinkorSwim mobile app. Timestamps 0:00 Intro 0:24 OCO Brackets on Open Positions 3:26 OCO Bracket on New Positions 6:19 OCO Bracket on Options Throughout the video we'll cover how to place an advanced order (OCO Bracket Order) on positions you currently hold, along with an opening trade, and how to place an OCO order on options contracts. The process is essentially the same if you’re attempting to create other types of advanced orders (1st triggers sequence, blast all, etc..) ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Create Study Alerts in ThinkorSwim

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll be going through how to create alerts based on studies within ThinkorSwim. Timestamps 0:00 Intro 0:29 RSI (Relative Strength Index) Alert 3:03 Simple Moving Average Crossover Alert 5:05 MACD Alert 7:26 Multiple Study Alert Setup We’ll be creating three separate alerts based on some of the most popular studies. These will be based off the RSI (Relative Strength Index), simple moving average crossovers, and MACD. Each one of these will be a separate alert all of which will activate independently. However, at the end we’ll combine them all and set the alert to only go off if all three conditions are met at the same time. Study alerts can be created for every type of condition you could be searching for. You can use the condition wizard to quickly create a study alert or utilize thinkscript to write the search criteria yourself. It can also be used to create alerts based off of corporate actions like earnings announcements, dividends, or up coming splits. ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm How I Make My Videos: Camera: https://amzn.to/3BjqYJY Lens: https://amzn.to/3hGIOhX Light: https://amzn.to/3wGg5OF Microphone: https://amzn.to/3hGJT9C Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Setup Futures Trader on ThinkorSwim

3K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to set up ThinkorSwim for futures trading. We’ll also cover how to place futures trades, find initial margin requirements and a few of the basics around futures trading. Before you can place your first futures trade you’ll need to make sure you have the necessary approvals. To apply for futures trading you need to first have a margin enabled and have options spread approval on the account. Once approved make sure you fully understand the risks before jumping into futures trading. These are highly leveraged products that can have some incredibly volatility. Throughout this video we’ll dive deep into the platform and customize it for futures trading. We’ll be doing most of this on the Futures Trader but it could just as easily be applied to the charts, flexible grid, or any other tab. We’ll also cover how you can find the initial margin requirements for each individual futures contracts and go through a few examples of placing trades.

How to Trade Spreads on ThinkorSwim Mobile App

3K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to trade spreads on the ThinkorSwim Mobile App. We’ll go step-by-step on how to place some of the most popular spreads like Verticals, Iron Condors, and Butterfly Spreads.

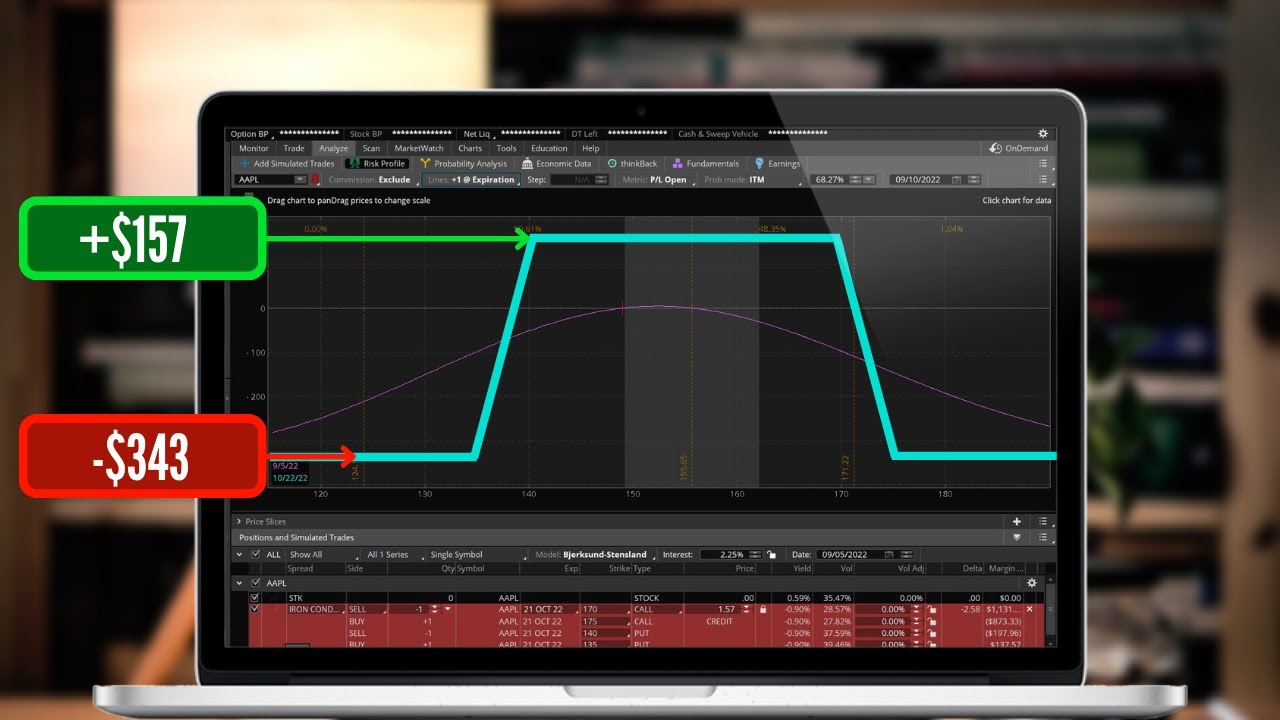

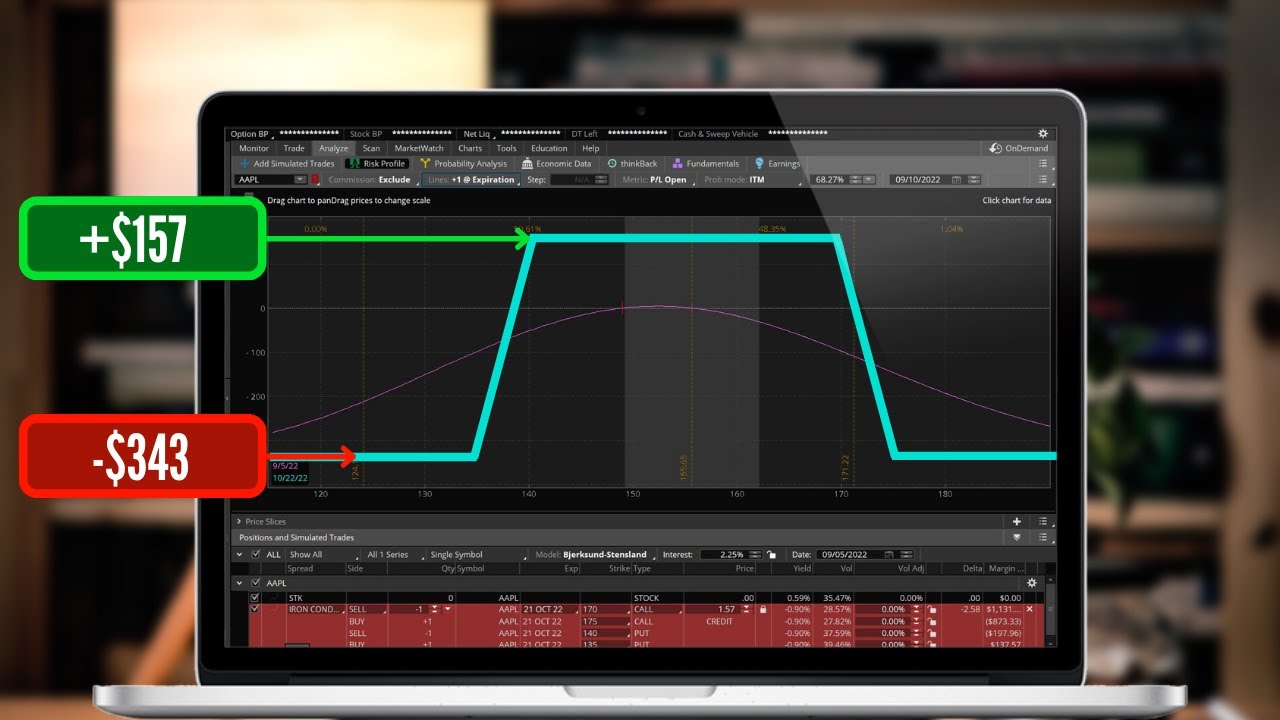

How to Trade and Understand Iron Condors on ThinkorSwim

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to trade iron condors on the ThinkorSwim platform. We’ll also dive into the basics of the iron condor spread itself, why you may want to use it and what to look for before you place the trade. It's important to remember that Iron Condors are neutral trades. Since they are not directional, they do not benefit from the stock moving one way of the other. They instead benefit from time decay and volatility decreasing. As time passes the options will slowly decay making you money over the duration of the trade. A volatility decrease will also cause the options to decrease in value, benefiting you. To create an iron condor you simply need to build out a short vertical put spread while also building a short vertical call spread. Time decay starts to ramp up around 30-60 days out which is why many options sellers will stick to this time frame. Occasionally, trading shorter time durations around earnings announcements to capitalize on volatility crush.

Placing Options Stop Loss Based on Stock Price on ThinkorSwi...

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to place stop loss orders on options contracts. However, instead of using the option price to activate the stop. We’ll be using the underlying stock price itself to active the stop. Throughout the video we’ll go through several examples of how to place stops on options using the underlying stock price. The first one will be on a position we don’t yet own but placing a stop along with the opening trade. The second will be on a long option you already hold in the account. Then finally we’ll do it on a short option as well since I know that can be a bit confusing.

How to Set Trailing Stop Loss on ThinkorSwim Mobile App

89 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to create a trailing stop on the ThinkorSwim mobile app. We’ll go through it both on an open position you already hold in the account as well as apart of an opening trade. We’ll also touch on how to customize the order ticket to make it a dollar offset, percentage offset, or tick offset. Although it exactly the same process, we’ll go through how to place trailing stops on both stock and options contracts. Trailing Stop A trailing stop order is an order that is entered with a stop parameter that creates a moving or "trailing" activation price. As a stock's price moves, the activation price for your order will move too – allowing potentially profitable trades to run, and may help protect against a sharp pullback.

How to Short Stock in ThinkorSwim

2K views · Dec 17, 2022 shortthestrike.com

In todays video we’ll be going over how to short stock on ThinkorSwim. Throughout this video we’ll go step-by-step through the process of shorting stock on the ThinkorSwim platform. There’s no special button you need to hit. You simply need to put in a sell order on a stock you don’t currently own. This will automatically be a short order. It’s all automatic, but what you’re essentially doing is borrowing shares from TD Ameritrade, then immediately selling those shares. Later down the line you’ll simply need to buy back those shares to cover the position. So remember, you sell to open. Then you buy back those shares to close. You then get to keep the difference.

How to Create and Customize a Watchlist on ThinkorSwim

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to create and customize a watchlist on ThinkorSwim. We’ll go through the process of creating a watchlist from scratch, pulling up past watchlists and customizing the columns to display the information we find most valuable. Creating a watchlist on ThinkorSwim is an incredibly easy process. I personally have several watchlists that are each focused on their own respective area. One watchlist is made to keep track of the index so I always know what’s happening with the overall market. Another is for stocks that I often sell options against. Finally, I always have dynamic watchlists which are simply scans searching for companies that meet my criteria. Once you’ve created a watchlist you can also edit the column headers to only display the information you find most valuable. This could things as simple as the last traded price, bid/ask, or volume. You could also include fundamental information like dividend yield or PE ratio. You could even add columns for studies like RSI, Implied volatility or VWAP.

Stock Market Order Types Explained | ThinkorSwim Tutorial

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll be going through all the order types available on the ThinkorSwim platform. This includes market, limit, stop, stop limit, trailing stop, and trailing stop limit orders. Market Order A market order indicates you want the immediate execution of an order for a stated number of shares at the next available price without any other restrictions. This means your order will seek execution once it is received by the market (as long as the security is trading). Limit Order A limit order indicates the highest price you are willing to pay for a security, or the lowest price you are willing to accept to sell a security. Your order will be executed at your designated price or better. This helps protect your order from sudden volatility, but it also means you will only buy or sell the security if it reaches the price you're seeking. Stop Order Stop orders can help you to limit your potential loss in an investment or to lock in profits. By setting an activation price below the market, if you are selling, you may be able to limit a potential loss should the stock price fall. Similarly, if you take a short position, you may be able to limit a potential loss if the stock price rises by placing a buy-stop order. Trailing Stop A trailing stop order is an order that is entered with a stop parameter that creates a moving or "trailing" activation price. As a stock's price moves, the activation price for your order will move too – allowing potentially profitable trades to run, and may help protect against a sharp pullback.

Customizing Gadgets in Left Sidebar on ThinkorSwim

10K views · Dec 17, 2022 shortthestrike.com

In today's video we'll learn how to customize the gadgets on the left sidebar on ThinkorSwim. The left sidebar can be customized to include any information you find most valuable. You can display account information, live news, level II data, time and sales, and much, much more.

How to Trade and Understand Short Vertical Spreads on Thinko...

3K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to sell vertical credit spreads in the ThinkorSwim platform. We’ll also dive into the basics of vertical spreads, things to look for before placing the trade, when to close them, and we’ll go through analyzing the trade to visualize how the trade can play out over time. A veritcal spread is made up of a short and long put/call at different strikes in the same expiration. A short vertical spread allows you to collect premium up front and take advantage of time and volatility decay. The spread allows you define your maximum profit and maximum from the beginning of the trade. Many options sellers will prefer to sell premium in high IV environments. Looking for not only implied volatility to be of a certain level, but also looking towards IV rank to confirm the stock volatility is sitting towards its upper end range. A short vertical put spread is a bullish, defined risk strategy made up of a long and short put at different strikes. Selling the option closer to the money while simultaneously buying a further out of the money put as a hedge against the stock going down in value. A short vertical call spread is a bearish, defined risk strategy made up of a long and short call at different strikes. Selling the call closer to the money while simultaneously buying a further out of the money call as a hedge against the stock going up in value.

How to Create Alerts on the ThinkorSwim Mobile App | TOS Mob...

200 views · Dec 17, 2022 shortthestrike.com

In today's video we'll learn how to create alerts on the ThinkorSwim Mobile App. Although far more limited on the ThinkorSwim desktop application, you do have the ability to create multiple different types of alerts on the TOS Mobile App. These alerts can be based off stock price, volatility, or used to find stocks with unusually high or low volume for the day. Within the desktop version of ThinkorSwim you can create an alert based off practically anything. This could be a study alert based off the RSI crossing below 30, or the stock crossing above the 50 day moving average. You could also create portfolio alerts or alerts on individual options contracts.

How to Add Studies and Drawing on ThinkorSwim Mobile

678 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how customize our charts on the ThinkorSwim Mobile App. This will include adjusting the time frame, adding studies, drawings, and changing the chart style itself. Although we only add the RSI and simple moving average crossovers in this video, you'll see there are many more studies in the app available to you. You also have the ability to customize the appearance of the studies as well as some of the inputs used to calculate the indicators. We also cover how to draw trendlines and support and resistance lines in this video. Like the studies, you have the ability to customize the appearance of the drawings themselves.

Custom Buy and Sell Side Volume Indicator for ThinkorSwim | ...

4K views · Dec 17, 2022 shortthestrike.com

In this video we’ll be loading a custom thinkscript into ThinkorSwim to provide a more detailed indicator for volume. This indicator will allow us to see both buy and sell side volume, premarket volume, average volume, and total volume for the day.

How to Chart Options on ThinkorSwim

4K views · Dec 17, 2022 shortthestrike.com

In today's video we'll learn how to chart options on the ThinkorSwim desktop platform. Charting an option will allow you too see the historical price of the contract as well as use some of the advanced tools specifically for the contract. You'll be able to use the active trader to trade them more quickly, use level II data to see open orders, and time and sales information to see past trades.

Custom Script for IV Rank and IV Percentile on ThinkorSwim

3K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to add a custom script for IV Rank and IV Percentile on each of our charts. If you trade options, being able to see volatility as well as a way to measure that volatility is incredibly important. Probably the most popular out there being IV rank, followed closely by the IV percentile although many platforms don’t offer this one. As I mentioned, each of these is used to uncover whether implied volatility is high or low compared to the past year. IV rank is by far the more popular of the two, but has some downsides. Because the calculation for IV rank uses the yearly low and high, it can be skewed if there has been a large swing in volatility in the past year. IV RANK = Current IV – 52WH / 52WH -52WL IV Percentile acts in a very similar manner, but attempts to counteract the affect of a large swing in volatility in the past year. It simply looks back the past year and looks at how many days volatility has been below the current volatility. IV Percentile = # of Days Below Current IV / # of Trading Day

Trading Options Using Stock Price on ThinkorSwim Mobile App

6 views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to place options trades using stock pricing on the ThinkorSwim Mobile App. In the first example we’ll go through the process of creating a stop loss order on an option contract based on the underlying stock price. To do this in the ThinkorSwim mobile app, you’ll bring up a closing order ticket just like normal. Once the order ticket is pulled up you’ll need to find and click on the “conditions” button. Once that opens you’ll find and click on the “Submit on Market Condition” button. You’ll then be able to use the stock price as a condition for submitting the order. In the second example we cover how to set up a 1st triggers OCO bracket order using the underlying stock price. As usual, you’ll pull up an order ticket and build out an opening trade on the option. Once done you’ll scroll down and find and click on the “Advanced Order” button. You’ll then be able to create your profit taking order and stop loss order for the option. For the profit taking order you’ll typically use the option price rather than the stock price. However, for the stop, you can then use the stock price as a condition to sell the option.

How to Exercise Options on ThinkorSwim

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll be going through the process of exercising options on the ThinkorSwim platform. As an option buyer, you have the right to exercise your option at anytime up until expiration. A call option grants the buyer the right to buy the underlying stock at the strike price up until expiration. Whereas the owner of a put option has the right to sell shares at the strike price up till expiration. Upon completion of an exercise request your option contract will be removed from the account and you will be left with the underlying stock. Although exercising options doesn’t make sense it most situations, there are times when the value captured can be greater than the remaining extrinsic value left in the contract. This could include times when a company pays a dividend, liquidity issues on the contracts themselves, or when considering tax ramifications. ➤ Open a tastyworks Account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Create a Dividend Scanner in ThinkorSwim

5K views · Dec 17, 2022 shortthestrike.com

In today’s video we’re going to create a dividend scanner on the ThinkorSwim desktop platform. Use this scanner to find dividend paying stock in the stock market. We’re going to create a basic template to weed out as many companies as possible. From there, we’ll go through the process of adding additional filter to narrow it down even further to only those dividend paying companies that you would actually feel confident holding for the long run. In this video we’ll narrow it down by the dividend yield of the company, price to earning ratio, average volume, stock price, and by industry. We’ll also go through several other filters you have access to and what you may want to look for when creating a scan for yourself. ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Premarket Movers Scanner for ThinkorSwim

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to a create a premarket scanner in the ThinkorSwim platform. Now if you’ve watched any of my past videos, you know how powerful the scanner is on the ThinkorSwim platform. You can pretty much scan for whatever is important to you whether that be based on technical indicators, fundamentals, or even patterns that may appear on the chart. In this video we'll be specifically looking for those stocks moving in the premarket. We can then hopefully find those stock preparing to breakout and find some trade opportunities. ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Trade and Understand Butterfly Spreads on ThinkorSwim

6K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll how to both trade understand butterfly spreads on the ThinkorSwim platform. The term butterfly spread refers to an options strategy that combines bull and bear spreads with a fixed risk and capped profit. These spreads are intended as a market-neutral strategy and pay off the most if the underlying asset does not move prior to option expiration. For it to work out you basically pick a price, usually right at the money, where you think the stock will be right at expiration. The bulk of the profit potential on the trade really wont come in until the day of expiration and even towards the last couple hours or even minutes of that trading day. So like I said, kind of like a lottery ticket. Low risk, high reward if your right. Although very unlikely you’ll be right.

Options Scanner on ThinkorSwim | Option Hacker Tutorial

1K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll be jumping into the ThinkorSwim desktop platform and learning how to create custom scans for options in there. The things you can scan for in here are near limitless. So in the video today we'll go through the process of adding many different filters and some recommendations for baseline filters. These will be options filters that you’ll likely use on all scans you create for yourself. By the end of this video, hopefully you’ll all feel a bit more comfortable with it, but you’re still going to need to practice yourself before you really know what you’re doing in here. Despite the fact we're scanning for individual option contracts that match our criteria, we obviously care about certain aspects of the underlying stock as well. Whether it be stocks in certain price range, or in a certain industry, maybe even that it pays a dividend, but obviously that stuff matters. ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Customize Platform Appearance on ThinkorSwim | Color ...

11K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll learn how to customize the overall appearance of the ThinkorSwim desktop platform. This will include changing the basic color scheme of the platform, changing various color settings, and adjusting the font size of the platform. Timestamps 0:00 Intro 0:17 Appearance Settings 1:01 Changing Color Scheme 2:04 Adjusting Platform Colors 5:34 Changing Font Size 7:07 Price Tick Color / Background To access the appearance settings menu you'll just need to head to the setup menu then select application settings. From there you'll find the tab marked look and feel. The look and feel menu tab will allow you to change the overall color scheme of the platform, create your own color settings, and adjust the font size for thinkorswim. ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Set Order Defaults in ThinkorSwim

2K views · Dec 17, 2022 shortthestrike.com

In today’s video we’ll go over how to setup order defaults within the thinkorswim. Now an order default is simply the order that automatically comes up when you go to place a trade. This will be the default quantity of shares or options being purchased, the order type being used, and order increments. ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Relative Volume RVOL Custom Script for ThinkorSwim

5K views · Dec 16, 2022 shortthestrike.com

Relative Volume, often called RVOL, is an indicator that compares current trading volume to average volume over a given period. This will then be displayed as a ratio so we can quickly see how active a stock is trading today in comparison to its average. Today we’ll quickly go over how RVOL is calculated, how to load a custom script in thinkorswim to view it, and a general review of how it can be implemented in your trading. When the indicator value is greater than one, the volume is higher than average; conversely, a value less than one means lower than average volume. Timestamps 0:00 Intro 0:25 RVOL Calculation 1:26 Loading Custom Script 4:23 How it Works 5:03 Outro ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Set Multiple Profit Targets in ThinkorSwim | OCO Brac...

2K views · Dec 16, 2022 shortthestrike.com

Advanced orders are an incredibly useful tool in ThinkorSwim that provide you a very simply way to automate some of your trading. These will allow you to set up multiple orders in advance, orders that trigger other orders, or set parameters to include both a profit target and stop loss. In today’s video we’ll be discussing on the many advanced orders types available within ThinkorSwim. Focusing mainly on the 1st triggers OCO, 1st triggers 2 OCO, and 1st triggers 3 OCO. These order types will allow you set your profit target and stop before you’re even in the trade. The 2 OCO and 3 OCO order types will allow to setup multiple different profit targets or stop targets before you even enter the trade. Timestamps 0:00 Intro 0:39 1st Triggers OCO 6:36 1st Triggers 2 OCO 9:11 1st Triggers 3 OCO 11:09 Active Trader Templates 13:27 Outro ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Import a Study or Script into ThinkorSwim

2K views · Dec 16, 2022 shortthestrike.com

The ability to load custom scripts, import studies and tools, or share workspaces is one the best features available in the ThinkorSwim platform. These scripts allow you to create new or improved studies, more advanced scans, and customize the platform in amazing ways. Today we'll go through the process of finding and sharing custom scripts, importing studies, and sharing workspaces. Timestamps 0:00 Intro 0:21 Sharing Link to Study 1:26 Importing Study Link 3:07 Sharing Workspace 5:19 Importing Workspace 5:53 Finding Custom Thinkscript 6:16 Loading Custom Script 7:38 Outro ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

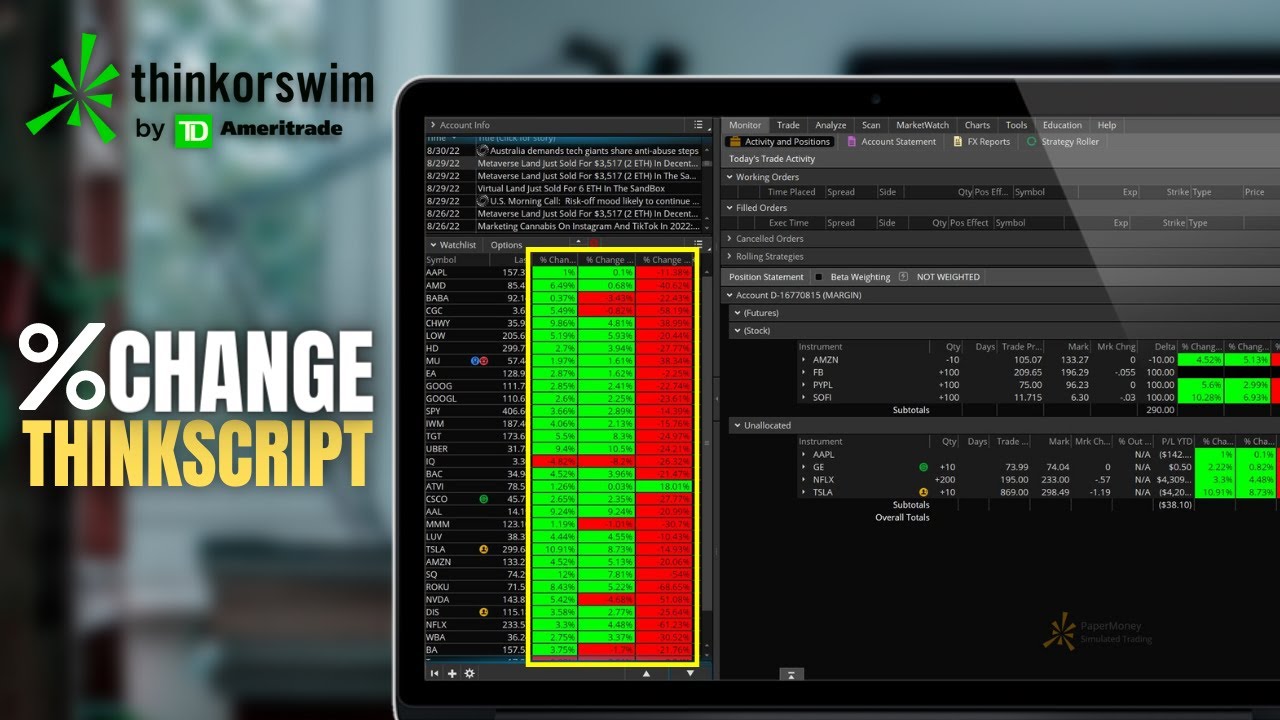

Best Custom Study Scripts for ThinkorSwim

6K views · Dec 16, 2022 shortthestrike.com

In today’s video we’ll be going through a few of my favorite custom scripts for ThinkorSwim. These scripts will include advanced volume bars, cost basis and profit/loss information, and a quick reference for the percent move of a stock. Timestamps 0:00 Intro 0:40 Advanced Volume Bars 3:30 Cost Basis / Share Quantity 7:51 Position Quantity Label 8:42 Today’s Volume Label 9:26 % Change Stock Info 11:25 Ex Dividend Date Column One of my favorite features on ThinkorSwim is the ability to load outside scripts. These scripts allow you create studies and features that wouldn’t normally be available on the platform. The things you can create and do using thinkscript is near limitless. However, in todays video I’ll be showing some of my favorite scripts for the platform that you may want to use for yourselves. I’ll also be posting each of these down below in the pinned comment for you to copy and then add to your own platforms. Advanced Volume Bars http://tos.mx/vZao14f Cost Basis Visually on Chart and P/L http://tos.mx/YubVGoA Todays Volume Label http://tos.mx/TVNpmGS Position Qty – Label on chart http://tos.mx/Z6Leh0u % Change Week to Date http://tos.mx/RuLiK2Q % Change Month to Date http://tos.mx/lhd05GL % Change Year to Date http://tos.mx/j0NkHH3 Ex Dividend Date Column http://tos.mx/AWZeGpe ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Set Up Hot Keys on ThinkorSwim

6K views · Dec 16, 2022 shortthestrike.com

Traders interested in placing trades as fast as possible are often drawn to Hot Keys. These Hot Keys will allow you to set a key or combination of keys to allow you quickly place trades or complete various other functions within ThinkorSwim. Since hot keys can be a bit confusing, today we’ll be going to through the process of setting up new hot keys, some examples of the most popular ones you’ll be using, and cover some of the unfortunate limitations in their use. ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

ThinkorSwim Tutorial for ABSOLUTE Beginners 2022

4K views · Dec 16, 2022 shortthestrike.com

Today we’ll be doing a comprehensive walkthrough of the ThinkorSwim Trading Platform for absolute beginners. ThinkorSwim is one of the best platforms out there for those planning to trade stock, options, futures, or forex. This tutorial will show you everything you could possibly need to know to get started trading on ThinkorSwim. We’ll discuss how to buy and sell stock, trade options, view charts, and some general customization. We’ll also go over the basics of buying and selling single leg options. More advanced tutorials on options trading will be covered in separate videos. If you have any questions about ThinkorSwim, options, investing, or real estate; Please let me know in the comments down below. Timestamps 0:00 Intro 0:29 How to Download TOS 1:47 General Navigation 3:17 Monitor Tab 5:41 Close Open Positions 11:24 Cancel / Edit Working Orders 12:41 Trade Tab 14:00 How to Buy & Sell Stock 15:15 Option Chain Explained 18:14 How to Trade Options 21:06 Chart Tab 22:50 Add Studies / Indicators 26:44 Side Panel 28:08 How to Create a Watchlist 30:53 Adjust Color Scheme 32:03 Change Order Defaults 33:49 Outro ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Active Trader on ThinkorSwim | Fastest Way to Trade In Think...

9K views · Dec 16, 2022 shortthestrike.com

The absolute fastest way to trade within ThinkorSwim is through the Active Trader tool. This is an absolute must for those of you day traders or scalpers out there who need to go in and out of a position as fast as possible. It's also full of important information like level II data and a simplified volume profile. Today we'll go through the Active Trader tool step-by-step to make sure you all have a solid understanding of how it's used. We'll also go through the process of creating templates within Active Trader to allow you create more advanced orders. ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm ➤My Website: https://shortthestrike.com/ Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Track Positions and Cost Basis in Charts | Custom Script for...

3K views · Dec 16, 2022 shortthestrike.com

Tracking your open positions and your profit and losses across ThinkorSwim can be a bit of a pain sometimes. There are a definitely few different fixes for this, but in today’s video we’ll be loading a custom script to make it much easier to manage this information right from our chart. This script will actually add labels that tell us our current position, our average price, and let us know how much we are up or down on the stock since opening it. Cost Basis Script: http://tos.mx/YubVGoA ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Rolling Options in ThinkorSwim | Step-by-Step Tutorial 2022

2K views · Dec 16, 2022 shortthestrike.com

Today we'll do a full step-by-step tutorial on how to roll options on ThinkorSwim. Rolling an options is simply closing out your current option contract while simultaneously opening a new one either further out in time or on a new strike. A roll would generally be considered as a way to manage risk, take profit, or to save a losing trade. ➤My Website: https://shortthestrike.com/ ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Scan for Spreads Using ThinkorSwim Spread Hacker

4K views · Dec 16, 2022 shortthestrike.com

Today we'll learn how to scan for spreads using the Spread Hacker in Thinkorswim. The entire purpose behind the spread hacker within thinkorswim is to filter through the millions of options out there and refine it to a small list of spreads you may actually want to trade. The spread hacker can be used to find vertical spreads, iron condors, butterfly's and various others that meet your criteria right now. ➤My Website: https://shortthestrike.com/ ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

ThinkorSwim Mobile App Tutorial for ABSOLUTE Beginners 2022

815 views · Dec 16, 2022 shortthestrike.com

Today Ill be doing a full step by step tutorial of the thinkorswim mobile app for absolute beginners. The thinkorswim mobile app still ranks as my personal favorite after testing pretty much every other platform out there. After today, you should all leave here feeling comfortable buying and selling stock, options, charting and overall more comfortable using the app. Timestamps 0:00 Intro 0:23 General Navigation 0:42 Change Color Scheme 1:26 Overview Tab 1:50 Create / Edit Watchlist 5:16 Positions Tab 7:20 Close Open Positions 10:18 Cancel / Edit Working Orders 13:42 Buy & Sell Stock 19:08 How to Short Stock 20:17 Option Chain Explained 22:40 Buying and Selling Options 25:40 Trading Option Spreads 28:31 Charting 29:20 Adding Studies 31:28 Balances & Margin 32:37 Editing Buttons 33:30 Outro ➤My Website: https://shortthestrike.com/ ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Fastest Ways to Trade Options in ThinkorSwim (Day Trading La...

5K views · Dec 16, 2022 shortthestrike.com

Today we’ll be going through several methods to trade options as fast as possible within thinkorswim. We’ll also create a few options trading layouts that will speed up the actual trading process. The two methods we cover in this video will include creating active trader template specifically for options and editing our platform settings to allow one click trades from the option chain. We’ll also create an active trader layout for multiple options as well as a more focused layout for single options trades. The active trader ladder is one of the fastest ways to place trades within thinkorswim. It allows you to place an option trade with a single click and this can for market, limit, and stop orders. You can also create trade templates that create more advanced orders like 1st triggers sequence or one cancels other bracket orders. Timestamps: 0:00 Intro 0:17 Options Trading layout 2:06 Active Trader 8:41 Single Option Layout 10:18 Option Chain 12:52 Outro ➤My Website: https://shortthestrike.com/ ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

How to Place Stop Loss Orders on ThinkorSwim Desktop

2K views · Dec 16, 2022 shortthestrike.com

Today we’ll be doing a full step by step tutorial on how to place stop loss orders within thinkorswim. We’ll be specifically going through the steps of adding a stop to your current open positions as well as attaching it to a brand new trade that we haven’t even opened yet. A stop loss order will generally be used as a way to close out an open position if the price moves against us. A stop can also be used to open new positions in the event of a breakout, but you'll mainly use it to limit losses. Timestamps 0:00 Intro 0:55 Place Stop on Current Position 5:09 Attach Stop to New Trade 7:15 Creating Templates 9:33 Outro ➤My Website: https://shortthestrike.com/ ➤ Open a tastyworks account: https://start.tastyworks.com/#/login?referralCode=PKSKCFVD2J ➤ Start Investing with M1 Finance: https://m1finance.8bxp97.net/151KXm Disclaimer: Some of these links go to one of my websites and some are affiliate links where I'll earn a small commission if you make a purchase at no additional cost to you.

Better Organize your Activity & Positions Tab on Thinkor...

5K views · Dec 16, 2022 shortthestrike.com